Why Are Restaurant Sales Dropping?

The evidence is irrefutable: After a decent start to the year, restaurants are having a tough time luring customers and getting them to spend. Recent weeks have brought a parade of operations posting second quarter losses (including the parents of Outback, Joe’s Crab Shack, Noodles and Company and Denny’s), and flat sales have become the new up, a cause for high-fives and trash talking. Even longtime high-flyers like Burger King, Buffalo Wild Wings and Taco Bell have suffered a meltdown in comps.

There have been a few shining exceptions (The Habit, for instance, posted a same-store sales increase of 4%, and Texas Roadhouse notched a 4.5% gain). Pizza chains in particular seem to enjoy some immunity. But the majority of big operations are coughing and wheezing. In June, comparable-store sales for chain restaurants fell by an average of 3.5%, the largest decline ever recorded by TDn2K, says Bob Rycroft, managing partner of the research firm.

And that poses the question of the moment: Why?

Choose any victim and you’ll readily get an answer. Seldom is it the same one you’ll get from another sufferer. A consensus has yet to emerge, leaving the concerned observer to choose from a bevy of theories—some plausible, some that sound like the wild guesses. Rycroft calls it a “stew” of ingredients ranging from politics to meal kits, “all of which seem to make sense.”

“There is no one factor,” agrees Darren Tristano, president of Technomic, the research sister of Restaurant Business. “There are a lot of things going on.”

Here are seven of the leading contentions, as espoused by financial analysts, researchers, economists and restaurant executives.

1. As far-fetched as this one might sound, its adherents include Steve Easterbrook, CEO of McDonald’s (which, ironically, posted one of the strongest comp gains among all quick-service brands, with a second-quarter rise of 1.8% domestically). He and others believe uncertainty fostered by U.S. politics and civil unrest have prompted consumers to pull back on spending and stay home more.

“There’s just a broader level of uncertainty in consumers’ minds at the moment,” he told analysts. “Whether through elections or through global events, people are slightly mindful of an unsettled world. And when people are uncertain, when families are uncertain, caution starts to prevail.”

Greg Trojan, CEO of BJ’s Restaurants, has a similar take: “It’s evident that we and all consumer-facing companies are navigating through unusual times, characterized by a confluence of social and political issues at home, weakening consumer confidence and increasingly global uncertainty.”

The thesis also explains why Domino’s was able to post a comp gain of 9.7% and Papa John’s could crow about a 4.5% increase. People may not want to leave the nest, but that doesn’t mean they want to cook. Pizza delivery has become a popular third option.

2. In fairness, there are plenty of qualms about Hillary Clinton, too, according to adherents of this thesis. They maintain that the extraordinary nature of the current presidential election has stoked uncertainty about the country’s direction, since neither candidate is what could be labeled a centrist. The possibility of economic change looms large for some, and that could rouse concerns about amassing an emergency fund to weather any storm, says Technomic’s Tristano.

That concern is nonpartisan, he says, though it might be slightly more pronounced for voters expecting the Republicans to win. “With Donald Trump, you might see more uncertainty,” he says. “That is definitely an issue.”

3. Hearing an orangutan recount the day’s sports scores might be less of a shock to industry veterans than the mounting indications of an independent uprising against chains.

“The hypothesis is that independents are taking away [market] share,” says TDn2K’s Rycroft. “If that’s true, and there are some indications it is, this is the first time this has happened.”

Technomic’s Tristano also gives credence to a tilt in preferences toward independents, noting reports from distributors that so-called street business is booming.

4. The surge in the number of chain restaurants over the last 40 years can be explained in no small part by the rise in fortunes of the middle class. So as the buying power of that socio-economic group erodes of late, it should not be a surprise that restaurants are feeling the pinch, many observers theorize.

“I can’t help thinking that the decline of the middle class has changed the way the public uses restaurants—the sort of places where they go, the sort of places where they like to eat,” says Rycroft.

That explanation addresses a polarization in restaurants’ performance. “Fine-dining and upscale-casual concepts are in a far better position,” notes Technomic’s Tristano, suggesting they might be pulling some 1-Percenters. Others note that low-price providers are also feeling less of an ebb in traffic.

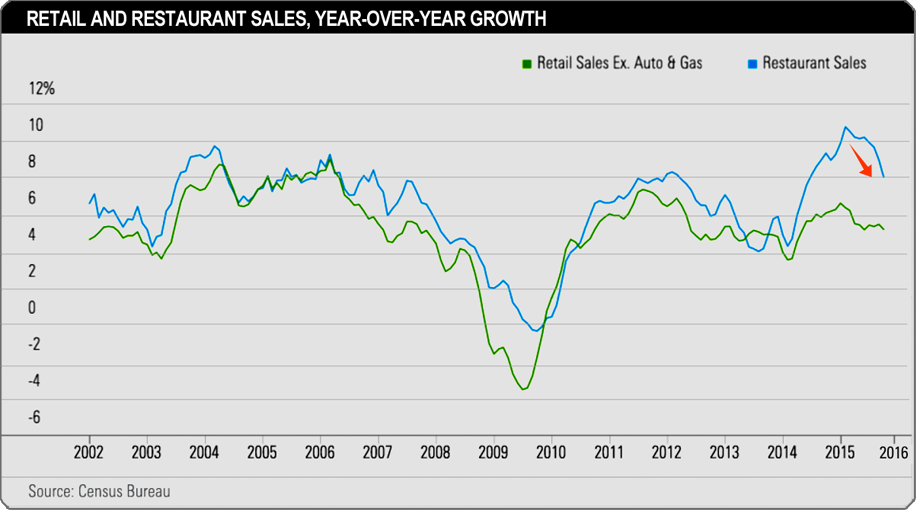

5. The U.S. Department of Commerce recently revealed that consumer spending accelerated during the second quarter, weighing against theories the public may be saving for a rainy day. So where is the money going?

Take your pick, say advocates of the heightened-competition theory. ”There’s simply more competition there than there was,” Doug Benn, CFO of The Cheesecake Factory, told analysts. “And the competition is coming from all over, including nonrestaurants such as grocery stores.

Technomic’s Tristano extends that list to include convenience stores, meal kit services such as Blue Apron and third-party delivery services that have put mom-and-pops squarely in the off-premise market.

Many note that supermarkets have amplified their price advantages over restaurants by lowering prices as commodity costs have fallen, sweetening the appeal for bargain hunters. Restaurants don’t have the same leeway because spiking labor costs leave no room to tinker with margins.

6. Private-equity funds and other investors have poured money into the industry in the last few years, changing both the pace and character of restaurant development.

“For many, many years, we saw the expansion flattening out. During that time, we saw some of the big-footprint restaurants close, so there were not only fewer places, but fewer seats,” says Tristano. “Now we’re seeing bigger restaurants.” He notes that newcomers like Shake Shack are building places large enough to generate $4 million in sales.

7. What may seem like an extraordinary time is just an unfamiliar new reality for the business. Liz Smith, CEO of Outback parent Bloomin’ Brands, noted that visits to casual-dining restaurants have decreased steadily for 11 years, but the pain was deferred by discounting to pull bodies through the door.

“Over the past couple years, traffic has been down a few points a year, but restaurants have been able to eke out a point or two of sales [gain] either through price or by managing the menu,” says Rycroft. It’s harder to pull off that feat when more places are doing the same thing and traffic is still ebbing.

“We’re looking at the industry to come,” says Tristano. “We’re looking at a more mature industry where it’s harder to grow. “Get used to it, because it this is the way it’s going to be. You’re going to have to work harder to do better.”

Source: RestaurantBusiness.com; by Peter Romeo

Even without an immediate need, restaurant owners are establishing lines of credit now. Being prepared is smart. Owners know opportunities and/or issues can arise quickly and having committed working capital allows them to be ready for the unexpected. Click here to learn more or request a Free No-obligation quote.