Steven Ensworth

Hi I’m Steven Ensworth, Vice President of Business Development at ARF Financial. I have over 10 years of B2B experience supporting local businesses in your area. I am very passionate about helping my clients achieve their goals. Whether you need capital for expansion, renovations, equipment, or just need help stabilizing your cash flow, I can assist you in choosing the right financial product that will support your circumstances. I would love to meet you to discuss how I can help you build on your success.

Through relationships with several community banks, I am able to provide working capital loans and lines of credit to accelerate growth and increase the value of your business. Our lending products are not a cash advance, but a commercial bank loan! I can deliver straightforward loan options based on your needs that feature fixed terms, low rates, and affordable payments.

Contact me at (754) 229-4040, email me or click the apply button below and I’ll work hard to get you the funding you need with the terms that make sense!

Andrew Mata

Hi I’m Andrew Mata, Vice President of Business Development at ARF Financial. I have over 10 years experience in the business financing helping owners promote, market and obtain the funds necessary to grow their businesses. I know the challenges you face and have hassle-free loan products to fit your specific needs. I welcome the opportunity to learn more about your business and look forward to providing a winning financial solution for you.

I can offer straightforward options that feature fixed terms and payments. Whether you are looking to expand to a new location, renovate, purchase equipment or simply stabilize your cash flow, I’m here to help.

Contact me at (954) 559-4709, email me or click the apply button below and I’ll work hard to get you the funding you need with the terms that make sense!

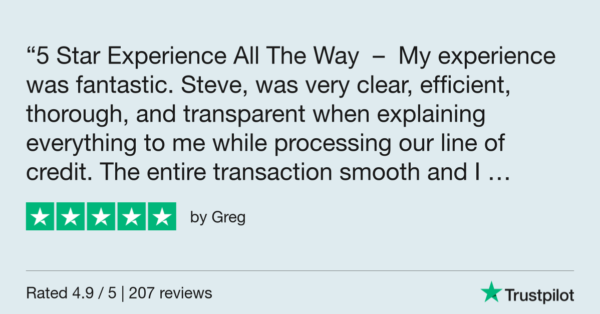

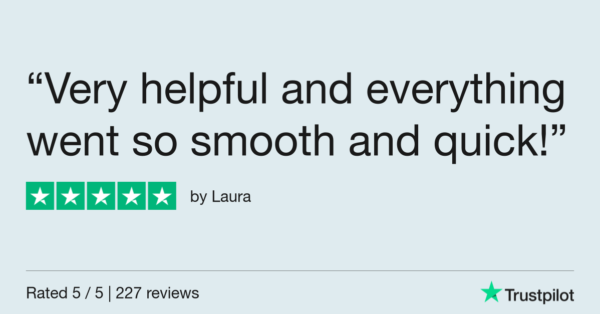

Business Development's TrustPilot Reviews

Jose Hidalgo

Hi I’m Jose Hidalgo, Business Development Analyst at ARF Financial. I am excited to support your businesses to reach any and all of your business goals. Whether it’s capital for expansion, renovations, equipment, or just a little help stabilizing cash flow, I can assist you in choosing the right financial product that will support your unique circumstances. I would love the opportunity to learn more about your business, your goals and discuss how I can help you build on your success.

Contact me at (754) 778-6744, email me or click the apply button below and I’ll work hard to get you the funding you need with the terms that make sense!