Celeste Deal

My name is Celeste Deal, Senior Vice President of Sales for ARF Financial. I bring over 15 years experience in B2B lending and finance to the company and am dedicated to helping my clients get the working capital they need to help grow their business. My professionalism along with a pragmatic approach to my client’s needs are what really set me apart. I value the traditional concept that the strongest foundations in business are built on trust and integrity. I welcome the opportunity to discuss our unique loan products and look forward to providing a winning financial solution for your clients.

Contact me at (832) 561-1424, send me an email, or or fill out the form below to find out how a Referral Partnership can be mutually beneficial.

PROGRAM DOCUMENTS

PARTNER WITH ME

You Can Sell Our Products!

Membership Programs

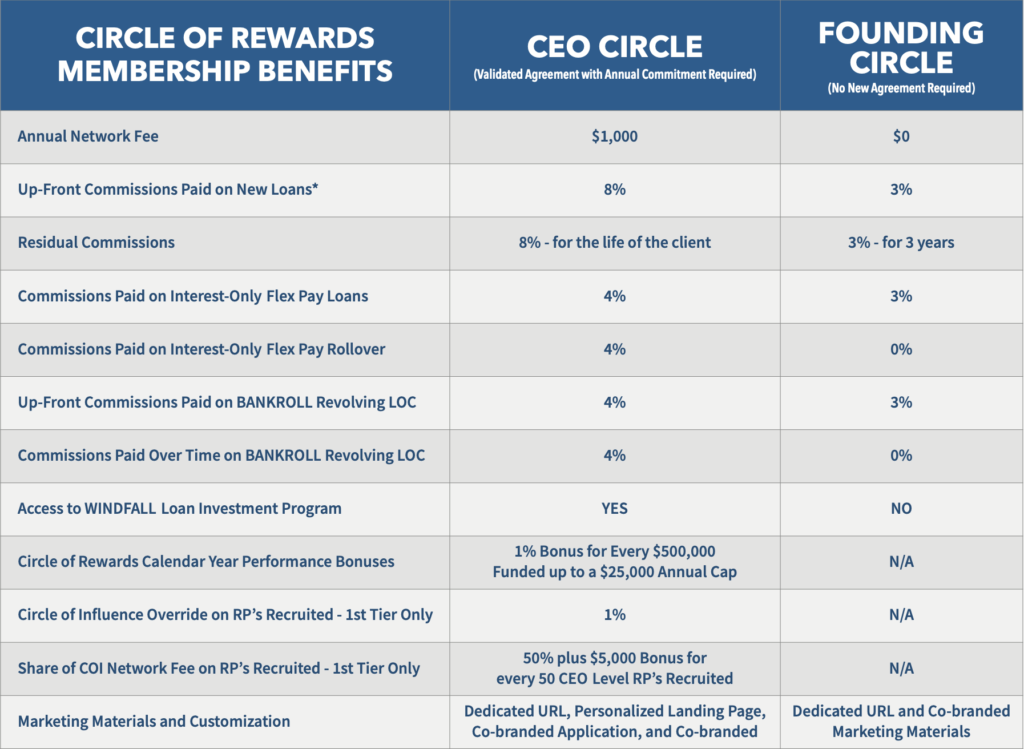

The new Referral Partner Membership Program benefits you, the Referral Partner as much as it benefits ARF Financial. It is designed to represent our long term commitment to building connected, long-lasting beneficial relationships with our Referral Partners. See comparison chart below for the three tiers.

Membership has its Rewards!

We are proud to offer one paid and one non-paid membership program for your consideration:

CEO Circle – Paid Plan:

The CEO Circle Membership Program is designed for brokers and larger referral partners with a strong network of associates and industry partners with established client portfolios. They also have the necessary bandwidth required to follow-up and maintain engagement with their client base. The CEO Circle Program requires an initial Membership Network Fee to join. By joining this membership program you will receive the highest up-front and residual commissions, the highest level of Circle of Influence Network Fees and Overrides and the highest level of monthly leads and marketing. Learn more…

Founding Circle – Non-Paid Plan:

The Founding Circle Membership Program is a continuation of our previous Referral Partner program. There are no annual membership fees. As before, this program pays 3% commission at funding and 3% commission on residual fundings for up to three years. Members will receive their dedicated URL which will track all online applications sent directly to our portal from your website or other marketing campaigns. By joining this membership program you will receive the lowest level of up-front and residual commissions. No Circle of Influence Network Fees and Overrides are offered at this level and no marketing is provided. Learn more…

For too long referral partner programs focused on a simple exchange of a commission for a referral without regard to the long-term success of either the lender or the referral partner. Envision a new time, a new path forward, where a circle of membership benefits are so strong, so mutually beneficial, and the revenue opportunity so big, you simply can’t pass it up!

Terms and Conditions do apply. Still have questions? Take a look at our comprehensive list of Frequently Asked Questions.

Contact me at (832) 561-1424, send me an email, or fill out the form on the left to start earning up to 8% for every qualified referral that you provide.

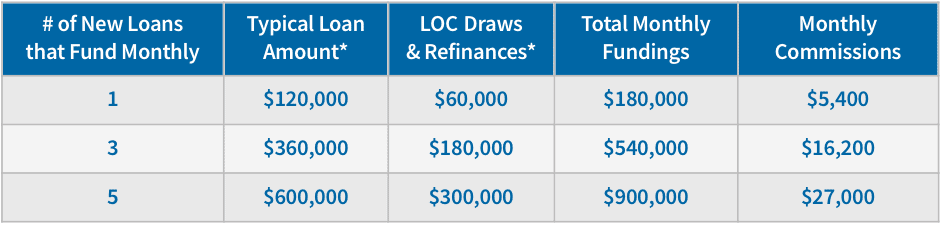

Continuous Revenue Stream

We will pay up to 8% referral fee, based upon the principal amount of the initial new merchant loan and the “cash out” portion of all additional advances, including line of credit draws, renewals, or re-financings that are made for a period of 3 years from the date of the initial loan. Here’s an example of the income opportunity:

*Based on choosing CEO Circle Membership and average loan amount per funding of $115,000

WHY REFER US

For over 20 years, ARF Financial has helped thousands of business owners capitalize on their potential – and we can do it fast. Our quick loan approval process means they can obtain a working capital loan, line of credit, or bridge loan in a matter of days.

We have built relationships with banks around the country so our clients can acquire a bank loan fast and with limited paperwork. That means the interest is tax deductible, rates are fixed, and the terms are spelled out ahead of time. Our clients get the financing they need rapidly, with affordable payments that won’t increase as revenue grows. In fact, we’ve helped thousands of merchants obtain approvals on more than 18,000 loans with proceeds in excess of $1 billion dollars.