Our Brightest Ever Referral Partner Rewards Program

Introducing our new Loan Stars Referral Partner Rewards Program designed for those passionate about supporting business growth and earning top-dollar commissions. By joining our Loan Stars program, you can unlock unlimited earning potential simply by referring clients to ARF Financial. Loan Stars get exclusive access to higher commission tiers, skyrocketing performance bonuses, new products and promotions with no annual memberships, expirations, or renewal fees. Each successful funding not only earns you a generous commission of up to 10%, but also empowers your clients to access the capital they need to succeed. Discover how you can make a significant impact and elevate your income with ARF Financial’s Loan Stars Referral Partner Rewards Program.

Read on to explore the vastness of our Loan Stars Rewards Program…

*Override commissions apply to first tier recruits only. **Self-serve marketing materials can be downloaded here. Customized materials including ARF landing page, cobranded online application and cobranded marketing materials are available for a $250 fee. Contact your loan consultant for details.

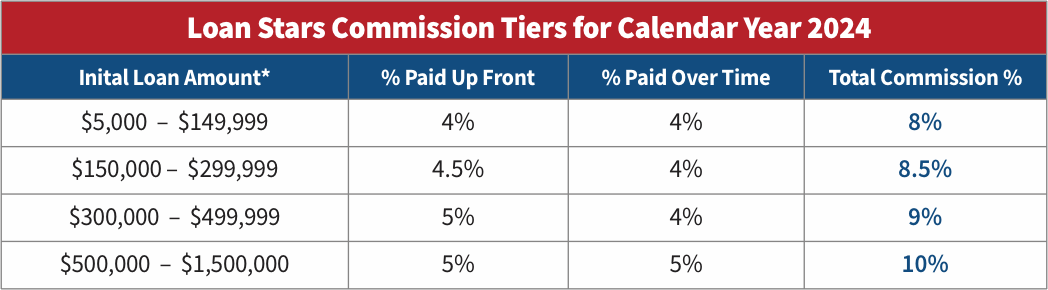

New Star-Powered Commission Tiers

Take advantage of Loan Stars increased earning power with our new escalating commission tiers. The higher the funding, the larger the payout – up to 10%!

*The initial loan amount (draw) determines the commission tier percentage paid, as well as the percentage paid on all subsequent draws. For a draw amount (or portion there of) to be eligible, it must increase the outstanding loan balance above the initial loan (draw) amount.

Skyrocketing Performance Bonuses

Performance bonuses will be calculated using eligible fundings retroactively from January 1st, 2024!

*Eligible funded amount refers to the total of the initial loan funding or refinance, plus any subsequent draws that increase the outstanding loan balance above the initial loan funding.

Current Partners with signed agreements prior to July 1, 2024, use links below.

Ready to Become A Star?

Complete the Form Below to Get Started

By introducing your clients to ARF Financial, you can help ensure the success of their business, strengthen your own relationships and earn significant income of up to 10% of the loan! Fill out the form below to get started.

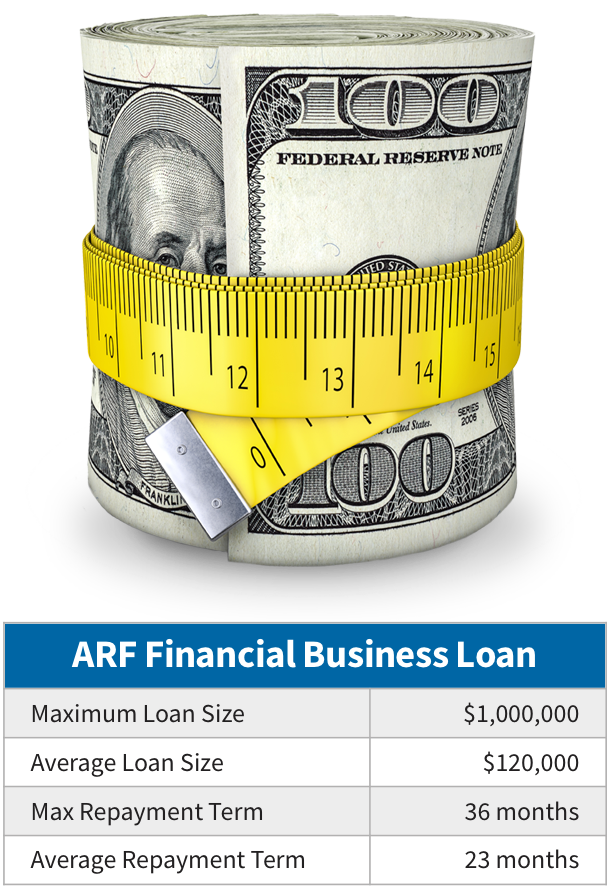

Larger Loan Amounts, Longer Terms & Big Rewards

ARF Financial provides loan amounts over six times larger and repayment terms more than three times longer than a Merchant Cash Advance. Larger loan amounts mean more commissions for you! And longer terms mean lower payments for your clients. Check out the comparison below:

Frequently Asked Questions

If you have questions related to our new star-powered commission tiers, skyrocketing performance bonuses, recruiting bonuses or overrides from downstream partners, we’ve assembled the answers to some of the most frequently asked here.

Ongoing Training Webinars

To ensure we are providing our brokers and referral partners, new and veterans, with the proper training they need to be successful in our program, we are hosting biweekly training webinars for anyone who would like to learn more about our program and get all the latest updates to our lending criteria. We are also hosting monthly, topical breakout sessions to assist veteran partners with additional product information, prospecting tips and ways to fill their pipeline.

Partnership Has Its Rewards

Partnership Re-imagined

At ARF Financial, we consider referral partners to be one of our most valuable assets, and in our commitment to ongoing program enhancements, we’ve launched our brightest referral rewards program yet – LOAN STARS. No Memberships. No Fees. Just a Galaxy of Rewards! As a Loan Star you’ll have access to higher commissions, higher residuals, more performance bonuses, and the ability to recruit your own network to earn overrides and on downstream fundings.

Better Loan Products

Why become a partner? For starters, to gain access to our industry-leading loan products. Our revolving lines of credit are ideal for your clients and even have an interest-only component. Plus, our average loan size is six times larger with terms over 3 times longer than a merchant cash advance! Larger loan amounts and longer terms mean higher commissions for you, and affordable payments for your clients.

Higher Commissions

The program doesn’t stop there. You can earn an industry-leading 10% commission on your referrals that fund. Unlike other programs that might have hidden fees, our straightforward and transparent commission structure ensures you receive the maximum earnings. Every loan that successfully funds translates to significant profit, making your partnership with us even more rewarding.

Capital Connections

Capital Connections is the go-to resource for our dedicated Referral Partners. From the latest promotions and webinar schedules to exciting contests and invaluable prospecting tips, Capital Connections covers it all. Discover new products, understand underwriting changes, and learn from success stories shared by fellow partners. Capital Connections also keeps you updated on critical industry news, including regulatory changes and how we’re adapting to them.

Loan Program Advantages

ARF Financial is a California licensed lender that has forged relationships with banks around the country that are committed to work with your clients so they can acquire a bank loan fast, without endless paperwork. That means the interest is tax deductible, rates are fixed, and the terms are transparent. Your clients receive the financing they need fast, with affordable payments that won’t increase as revenue grows.

Business Types We Lend To

From restaurants to liquor stores, to doctors and manufacturers, ARF Financial’s unique loan products help keep a wide variety of businesses growing and profitable. Here are a few of the many business types we can help:

Our Unique Loan Products

Interest-Only Bankroll Revolving Line of Credit

Exclusive new product just released: Think of it as Bankroll on steroids. This product works just like our current Bankroll Revolving Line of Credit with the added benefit of interest-only payments for up to a year! This amazing new product also pays 4% upfront and 4% over 12 months, just like our Bankroll Revolver.

Bankroll – Revolving Line of Credit

Your business is always evolving. Wouldn’t it be great to have a loan product flexible enough to evolve with it? Now you do! Our new Revolving Line of Credit – BANKROLL, provides the MAX loan approval, a fixed loan term up to 36 months, and a fixed weekly payment – plus the flexibility to pay down or draw funds on an unlimited basis!

Minimum Qualifications

Industry Type

We lend to more than just restaurants. We have expanded to include many more approved industries. Click here to see the full list.

Credit Score

Your clients don’t need perfect credit to qualify. Applicants with an Equifax credit score of 551 or higher are acceptable.

Time in Business

Applicant must own the business. The business must be open and operating under the same ownership for at least one month (30 days).

Annual Sales

Your business must generate a minimum of $17,000 per month in sales ($200,000 annually) from both credit card and cash.

Quick & Easy Way to Apply

If you you have a client / business owner in need of working capital, simply have them complete our online application today. Every Partner receives a dedicated link to our online application for tracking purposes. There are 4 prequalification questions, 5 easy steps, and there is no hard credit pull so their credit will not be affected. Clients may also speak to your assigned loan consultant who is knowledgeable about the market, which loan product is the right fit, and will work with you and your client throughout the process.