Marie Lokmanyan

Hi, I’m Marie Lokmanyan, VP of the Broker/Iso Division at ARF Financial. I previously worked with Wells Fargo Bank as a Private Banker for over 10 years. My 20 years in commercial banking gives me an unusually broad base of experience with which to address your business financing needs, and since I worked in traditional banking most of my career, I understand the challenges and the ridiculous loan qualification process business owners have to face. At ARF financial we provide a simple and direct answer. Our approval process is transparent and we typically fund your loans in 3-5 days.

I am a firm believer in supporting local businesses which is why I am passionate about helping local businesses grow and provide them with capital they need to survive and thrive. I have experience with many different types of commercial financing, and with this knowledge I will be able to assist you with making the right choice when it comes to funding your business.

Whether you need capital for expansion, renovations, equipment, or just need help stabilizing your cash flow, I can assist you in choosing the right financial product that will support your circumstances. I would love to meet you to discuss how I can help you achieve your goals.

Through relationships with several community banks, I am able to provide working capital loans and lines of credit to accelerate growth and increase the value of your business. Our lending products are not a cash advance or a factoring company, but a commercial bank loan! We have nothing to do with credit card transactions. The loan you receive is tax deductible resulting in lower overall cost of funds. The payments you make are fixed and will not change during the term of the loan – as your revenue grows you keep more of it.

Contact me at (310) 402-1600, email me or click the apply button below and I’ll work hard to get you the funding you need with the terms that make sense!

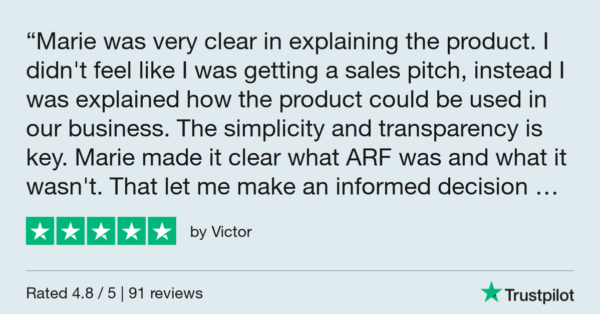

Marie's Trustpilot Reviews

Product Information

Use our Business Loan Calculator to Find Out How Much You Qualify For:

Use our Business Loan Calculator to determine the potential loan amount you may qualify for. Move the sliders below to indicate your business’s annual sales, time in business, your credit score, whether you own a home, and if you’ve declared bankruptcy and the calculator will serve up your potential loan amount based on 12, 18, 24 and 36-month terms!

| Term | Loan Amount |

|---|---|

| 12 month | |

| 18 month | |

| 24 month | |

| 36 month |

Use our Business Loan Calculator to determine the potential loan amount you may qualify for. Move the sliders below to indicate your business’s annual sales, time in business, your credit score, whether you own a home, and if you’ve declared bankruptcy and the calculator will serve up your potential loan amount based on 12, 18, 24 and 36-month terms!

TERMS AND CONDITIONS

ARF Financial LLC is an exclusive third party originator and servicer of commercial loans for state charted community banks throughout the United States (“Partner Banks”), (collectively herein referred to as “Lender”). This Preliminary Loan Amount is based upon pre-underwriting standards consistent with Lender’s guidelines. This Preliminary Loan Amount is based upon the information provided by the Merchant in the Loan Calculator. This approval is contingent upon the accuracy and truthfulness of the information provided by the Merchant therein and on any additional information discovered by Lender during the Underwriting process including but not limited to the review of all financial information provided by the Merchant, the personal credit of any guarantor and/or any information available from the public domain relating to the business’ or the guarantor’s outstanding liens and judgments, collection issues, history of fraud, bankruptcy, or criminal activity; the status of the Merchant’s business entity with the State where they are located; or any other information that may reflect on the business or guarantor’s ability to repay this loan. The terms of this Preliminary Loan Amount may change based upon the review of all information noted above. The terms of this Preliminary Loan Amount (noted above or if modified during the Underwriting process) are not deemed approved until the Merchant agrees to and executes all necessary Loan documents and the Loan documents are countersigned and approved by an Officer of Lender. If Merchant executed no Universal Merchant Credit Application then this Preliminary Loan Amount is for discussion purposes only.