Make the Best Choice for Your Bottom Line

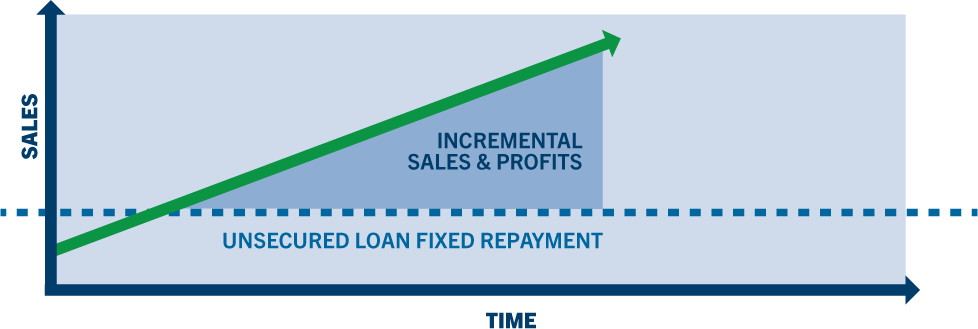

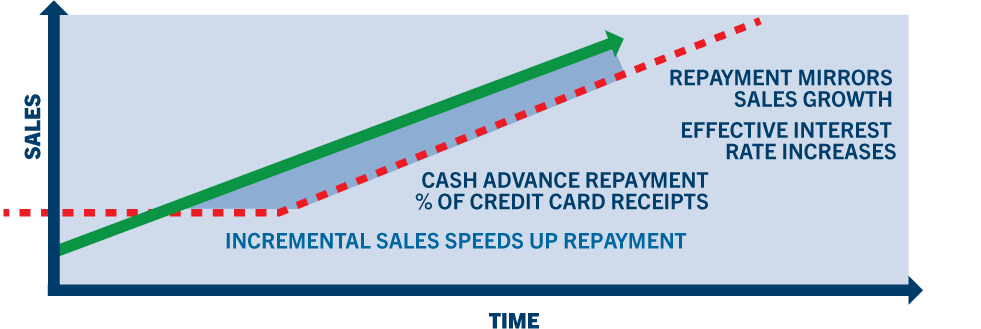

A merchant cash advance (MCA) is an alternative form of financing where the cash provider purchases a fixed amount of a merchant’s future credit card sales, typically at a significant discount (up to 50%). The MCA is paid back from a percentage of the merchant’s daily credit card receipts, which means that the business’ payments go up as its sales and profits do. In other words, the more successful a business owner is, the faster the cash advance provider gets paid back, escalating the business’ effective interest rate to astronomical heights. As shown in the diagrams below, a business loan from ARF Financial, with longer, fixed terms, allows a business owner to keep the additional profit generated from their hard work!

A merchant cash advance is very different than a business loan. It is a form of factoring where a financial services company agrees to buy an amount of your future credit card sales at a discount, typically from 30% to 38%, and then electronically debits a percentage of your daily credit card receipts until the agreed upon amount has been paid back.

Why a Business Loan Works

Why a Cash Advance Doesn’t Work

The problem? As shown in the graph, the more money you make (higher sales), the faster the cash advance provider gets paid back, thus raising the cost of funds to your business significantly. The shorter the term, the more expensive the advance becomes.

Restaurant owners, like many small businesses, are frequently being offered cash advances by a myriad of companies and/or brokers. Unfortunately, with many cash advance providers, your payment can change each week, or even daily, based upon your credit card sales. While merchant cash advances may appear to be a quick and easy option for busy restaurant and small business owners, the reality is a business loan is actually just as quick and way less expensive in the long run. ARF Financial offers larger loan amounts, longer terms and fixed, weekly payments that never change – great for budgeting and cash flow. All too often, the actual cost and inner workings of a merchant cash advance depends on the company offering it. With ARF Financial, there is no need to change your existing credit card processor, no complicated reconciliations to perform, and the repayment terms are made clear up front.

If your restaurant business is growing, don’t pay back your cash advance with a percentage of your Visa and Mastercard sales! As a successful restaurateur, why undermine your business’ operating health by giving away your new increased sales? Also, unlike a merchant cash advance, the interest on our business loans is tax deductible. This effectively lowers the total cost of your cost of funds even more in the long run.

A business loan with ARF Financial is the preferred choice compared to a merchant cash advance. Rates are lower, payments are fixed, terms are longer and the interest you pay is tax deductible. Most importantly, as your sales increase, your payments remain fixed. That means you, the restaurant owner, reap the benefits of increased sales, not the cash advance company. No matter what the future holds, ARF Financial is your best choice for a business loan, restaurant loan, or restaurant financing to capitalize on new opportunities – often when conventional banks simply won’t consider it.

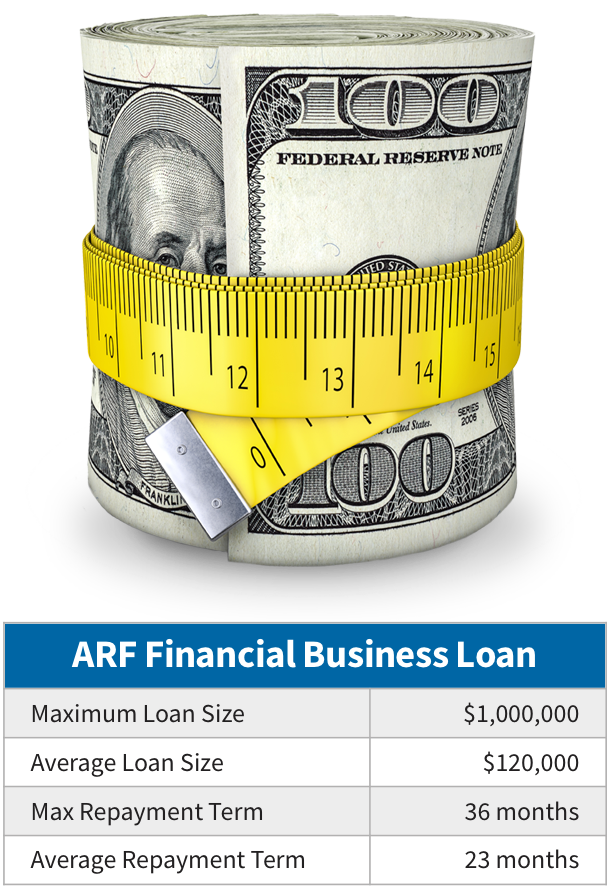

Larger Loan Amounts, Longer Terms and Big Rewards!

Expansion projects, renovations, and additional locations are all big decisions that can bring big returns. However, big projects usually mean big upfront investments, something you can’t get from a merchant cash advance. If you’re ready to go BIG this year, we have financing that’s the perfect fit. You can now borrow up to $1,000,000 with terms up to 36 months to fund those big projects while keeping your costs low. Our average loan size is over six times larger and repayment terms are more than three times longer than a Merchant Cash Advance. Larger loan amounts mean you can invest in growth opportunities that will make a significant impact to your bottom line, and longer terms mean your payments are manageable and won’t interfere with your cash flow! Check out the comparison below.

Completing an application only takes 10 minutes and won’t affect your credit.

Why a Business Loan from ARF Financial Works Best

Transparency

ARF Financial’s loan terms are transparent and are spelled out in detail on the first page of the Loan Agreement. With an MCA, the agreement fails to identify the cost of borrowing the money, the term of the payback and the amount of the daily, weekly or monthly payment. And, the payments are variable – meaning they can go up materially if your business investment pays off and your sales grow! Do you want to enter into a financing agreement without knowing and understanding these critical terms?

Line of Credit

Business owners only want to borrow money when they need it. And, why pay interest before you need to? ARF Financial offers Lines of Credit to its clients for those simple reasons. In addition, we have flexible repayment options like principal deferment to keep your costs low. Cash Advance providers don’t offer typical bank features like this, because their product is not a loan.

Ability to Pay Off Early

ARF’s business loans can be paid off early and business owners only pay interest for the time they keep the money. Not so with a Merchant Cash Advance. Business owners with an MCA are forced to pay off the entire balance (with no discount) even if repaid one week after it is taken.

Cash Flow

ARF Financial’s business loans provide 12 to 36-month terms, more than 3 times longer than the typical 6 to 9-month terms given by MCA providers. Longer terms yield lower payments and materially improved cash flow.

Higher Loan Amounts

ARF Financial provides some of the highest loan amounts in the industry, up to 33% of a merchant’s total annual sales (cash plus credit card sales). Merchant cash advances are typically based upon a merchant’s credit card sales alone or one month of total sales, providing materially lower cash out amounts for borrowers. Our average loan size ($120,000) is over 6 times larger than a merchant cash advance!

Professional Support

ARF Financial employs seasoned financial consultants to provide one-on-one support through the application and funding process. They live and work in the communities they serve, providing clients with local market knowledge and critical financial guidance over the life of their business.

Tax Benefits

The interest paid on an ARF Financial business loan is an ordinary business expense and is tax deductible. Merchant Cash Advances represent future sales sold at a discount and have no clear tax benefit to the business owner.

Quick & Easy

Business loans from ARF Financial can be approved within 24 to 48 hours, and can be funded within 3 days of a completed application. Some Merchant Cash Advance providers say they can fund within an hour. How can they fashion the right loan to fit your business in an hour?

Trust & Credibility

Trust and credibility are built over time, and business owners agree they look for lenders with a at least 10 years of experience and a proven track record. Since 2001, ARF has helped tens of thousands of clients obtain approvals with proceeds in excess of $1 billion. ARF is licensed by the State of California and partners with state-chartered community banks nationwide.

Quick & Easy Online Application