Attention all Referral Partners! Get excited for ARF Financial’s newest financing option, The Big Deal. With loan amounts up to $1,000,000 and repayment terms up to 24 months, The Big Deal term loan is the ultimate solution for clients seeking a significant boost in capital while waiting on an SBA loan or conventional bank financing. Whether it’s for financing large equipment purchases, stocking up on inventory and raw materials, expanding to a second location, or facility renovations, this financing option is perfect for growing businesses.

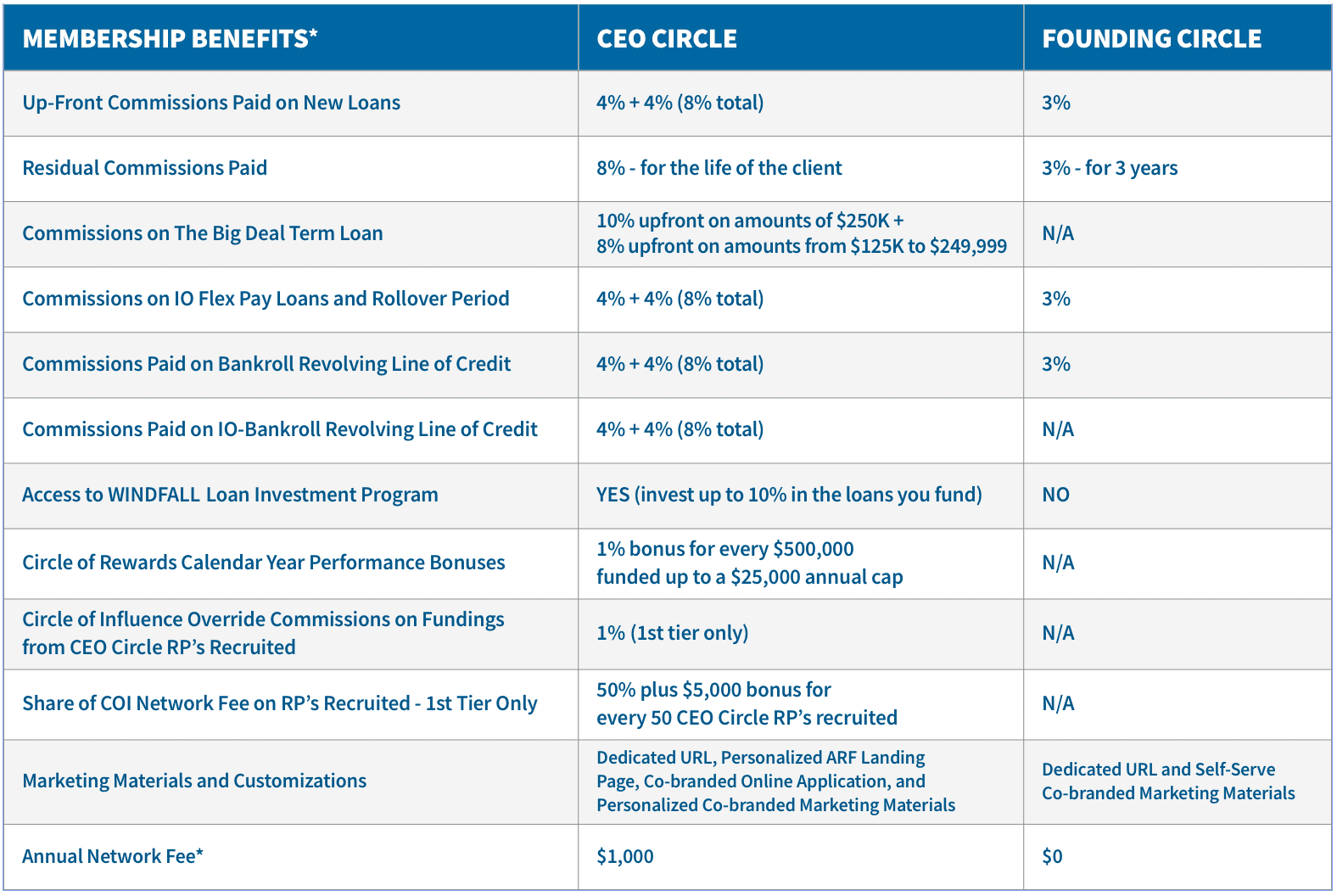

Here’s where it gets even better – CEO Circle Members can earn up to 10% commissions UPFRONT on the initial funding, as well as any subsequent line of credit drafts the client takes. Now, that’s what we call a Big Deal!*

The Big Deal’s Big Advantages

CEO CIRCLE MEMBERSHIP FORM

CEO Circle vs Founding Circle Membership Benefits

Larger Loan Amounts, Longer Terms & Big Rewards

Big projects usually mean big upfront investments, something your clients can’t get from a merchant cash advance. If you have clients who are ready to take the plunge and go BIG this year, we have financing that’s the perfect fit. They can now borrow up to $1,000,000 with terms up to 36 months to fund big projects while keeping their costs low. Our average loan size is over 6 times larger and repayment terms are more than 3 times longer than a Merchant Cash Advance. Larger loan amounts mean they can invest in growth opportunities that will make a significant impact to their bottom line, and longer terms mean their payments are manageable and won’t interfere with their cash flow! Check out the comparison below.:

Minimum Qualifications

Industry Type

We lend to more than just restaurants. Over the years we’ve expanded our approved industry types. Click here to see the full list of industries.

Credit Score

Even with less than perfect credit, we can get you approved for a working capital loan. An Equifax credit score of only 551 is required.

Time in Business

Applicant must own the business. The business must be open and operating under the same ownership for at least one month (30 days).

Annual Sales

Your business must generate a minimum of $17,000 per month in sales ($200,000 annually) from both credit card and cash.

Use of Funds

At ARF Financial, we understand the changing business landscape. As such, business owners use our financing for a variety of reasons. The Big Deal Term Loan is ideal for merchants who are experiencing strong performance, but need an injection of capital to take advantage of growth opportunities, while waiting on an SBA loan or conventional bank financing.

Customer Reviews