Powerful Benefits for CEO Circle Members

You might be asking, “what is COREight?” Well, it stands for Circle of Rewards (COR) now offers 8% commissions! At the core of ARF Financial’s Circle of Rewards Membership Program is its ongoing commitment to pay top-dollar commissions, residuals, milestone bonuses, and overrides that build wealth and steady income for our member partners, while providing the highest loan amounts (up to $1,000,000) over the longest terms (up to 36 months) to member clients. To further our commitment, we are proud to continue adding powerful upgrades to our CEO Circle Membership!

CEO Circle Members Can Now Take Advantage of these Powerful Upgrades

Celeste covers all the powerful upgrades that come with our CEO Circle Membership.

CEO Circle Member Benefits

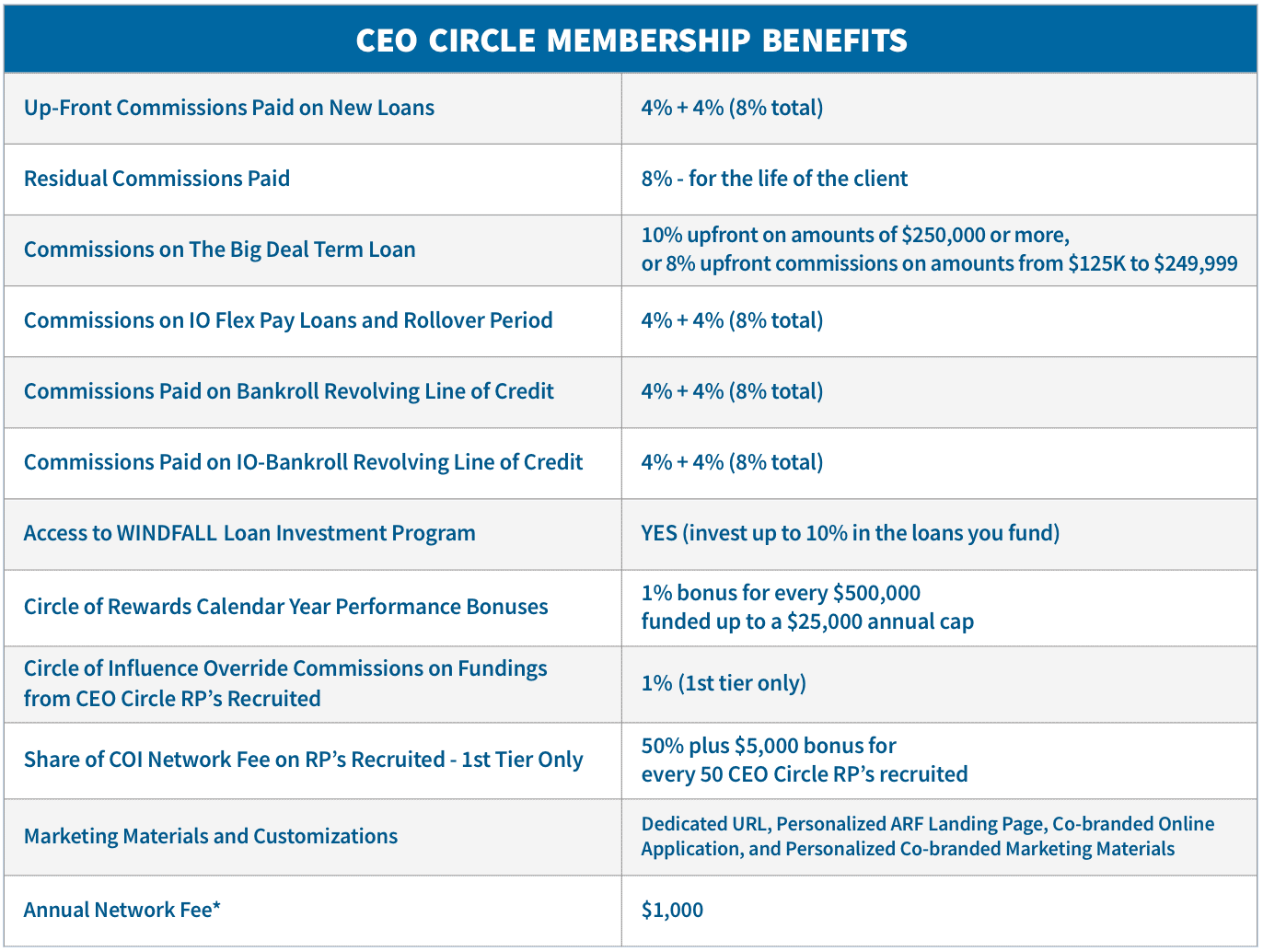

With increased upfront and residual commissions, performance bonuses, overrides from downstream members and a new Loan Investment Program, it’s the perfect time to become a CEO Circle Member! Check out all the valuable new benefits that come with a CEO Circle Membership vs. Founding Circle.

Complete the Form Below and Start Earning 8%!

By introducing your clients to ARF Financial, you can help ensure the success of their business, strengthen your own relationships and earn significant income! Fill out the form below to get started.

We Now Offer One Enhanced and One Entry-Level Membership

CEO Circle Membership

By joining our CEO Circle you receive the highest up-front and residual commissions (8%), a share of the network fees and override commissions on fundings from your Circle of Influence, plus a dedicated link to our online application, personalized ARF landing page, co-branded online application, and co-branded marketing materials.

Founding Circle Membership

By partnering with us and becoming a Founding Circle Member, you receive the standard level of up-front and residual commissions (3%). There are no Circle of Influence network fees or override commissions offered at this level. A dedicated link to our online application and co-branded marketing materials will be provided.

Circle of Rewards Referral Partner Membership Program Updates

CEO Circle Members

Our CEO Circle Members will be paid top-dollar commissions (up to 8%) on every new loan they fund, plus up to 8% residual commissions on subsequent fundings as long as they remain an active CEO Member. Here’s a list of all the valuable benefits that come with a CEO Membership:

Founding Circle Members

The Founding Circle Membership is a continuation of our previous Referral Partner program. There are no annual membership fees. As before, this program pays 3% commission at funding and 3% commission on residual fundings for up to three years.

WINDFALL – Loan Investment Program

ARF Financial’s new Loan Investment Program, WINDFALL is designed to build wealth and provide a steady income among our CEO Members. Any active CEO Circle Member now has the option to invest up to 10% of a loan they fund and reap the WINDFALL!

Larger Loan Amounts, Longer Terms & Big Rewards

You can now borrow up to $1,000,000 with terms up to 36 months to fund your big projects while keeping your costs low. Our average loan amount is over six times larger and repayment terms are more than three times longer than a Merchant Cash Advance. Larger loan amounts mean you can invest in growth opportunities that will make a significant impact to your bottom line, and longer terms mean your payments are manageable and won’t interfere with your cash flow! Check out the comparison below:

Our Unique Loan Products

BANKROLL – Revolving Line of Credit

Your business is always evolving. Wouldn’t it be great to have a financial product flexible enough to evolve with it? Now you do! Our new Revolving Line of Credit – BANKROLL, provides the MAX loan approval, a fixed loan term up to 36 months, and a fixed weekly payment – plus the flexibility to pay down or draw additional funds on an unlimited basis!

Interest-Only Flex Pay Loan

We believe growing your business shouldn’t mean sacrificing your cash flow, and with ARF’s new Interest-Only Flex Pay Loan it doesn’t. It now allows you to quickly access from $50,000 to $750,000 without collateral and low, interest-only payments for up to 1 year. And now, it also carries an optional Line of Credit with unlimited draws for up to a year!

Interest-Only Bankroll Revolving Line of Credit

Think of it as Bankroll on steroids. This product works just like our current Bankroll Revolving Line of Credit with the added benefit of interest-only payments for up to a year! This amazing new product also pays 4% upfront and 4% over 12 months, just like our Bankroll Revolver.

Flex Pay Loans

Many merchants simply don’t dream big because they believe they can’t afford to borrow the funds needed to make those dreams real. Our Flex Pay loan solves that problem! Flex Pay allows your clients to defer up to 50% of their loan principal into the future, resulting in the lowest payments now!

Minimum Qualifications

Industry Type

We lend to more than just restaurants. Over the years we’ve expanded to include many business types. Click here to see the full list of industries.

Credit Score

We can work with merchants that have less than perfect credit. An applicant must have a minimum Equifax credit score of 551 or higher.

Time in Business

Applicant must own the business. The business must be open and operating under the same ownership for at least one month (30 days).

Annual Sales

Your business must generate a minimum of $17,000 per month in gross sales ($200,000 annually) from both credit card and cash.

Complete the Form Below and You Can Sell Our Products!

By introducing your clients to ARF Financial, you can help ensure the success of their business, strengthen your own relationships and earn significant income! Fill out the form below to get started.