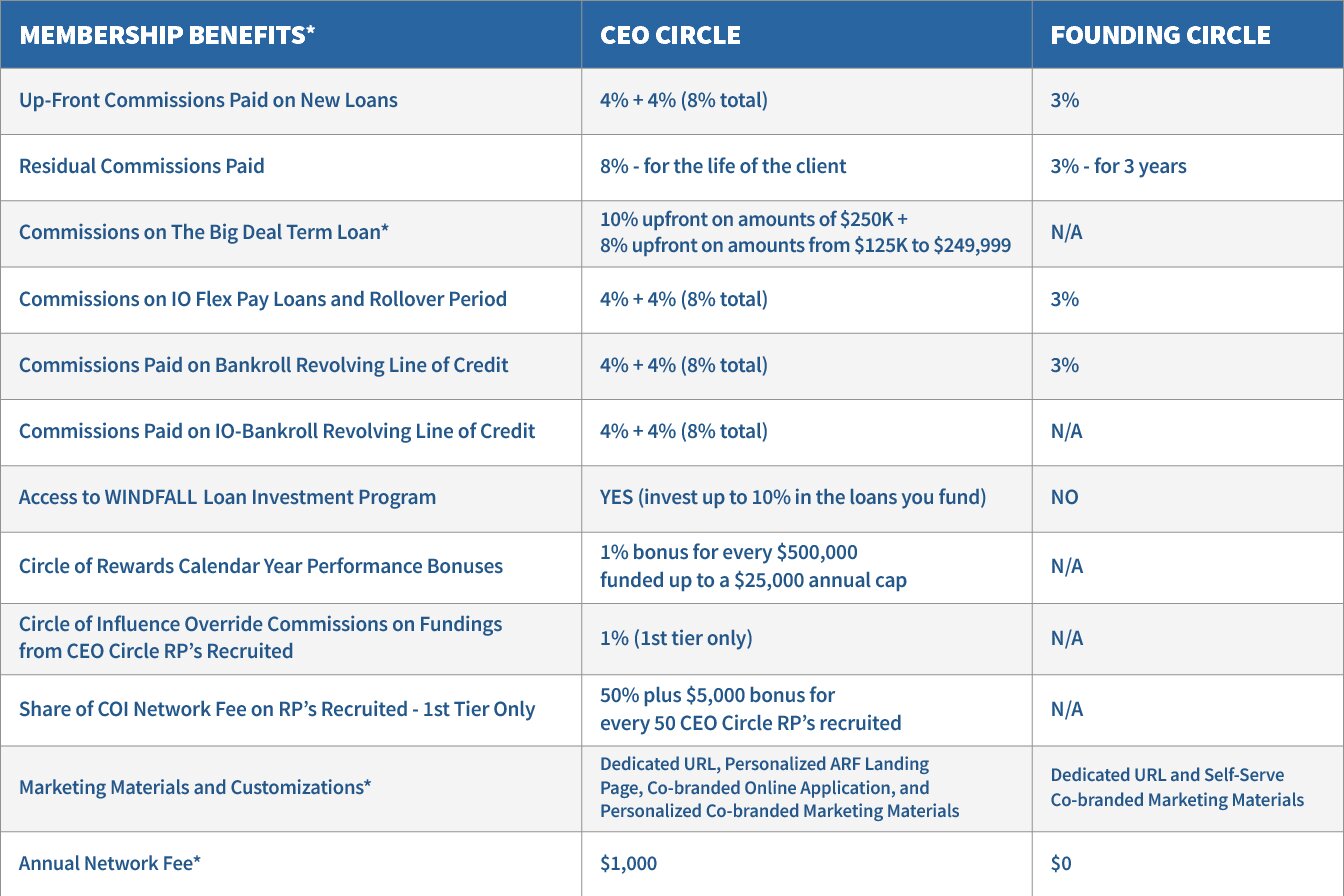

Get More in 2024 with a 90-Day CEO Circle Free Trial Membership! Experience top-dollar commissions and valuable benefits that build wealth and a steady stream of income.

Benefits Include:

.

The sign up period for the 90-Day free trial will run from January 1st to March 31st, 2024. At any time before the 90-day trial period is over, you are invited to join the CEO Circle. That gives you up to 15 months to take advantage of increased upfront and residual commissions, generous performance bonuses, overrides from downstream members and a loan participation program! If you choose not to join the CEO Circle before the 90-day trial is over, your membership will automatically default to Founding Circle.

Larger Loan Amounts, Longer Terms & Big Rewards

ARF Financial provides loan amounts over six times larger and repayment terms more than three times longer than a Merchant Cash Advance. Larger loan amounts mean more commissions for you! And longer terms mean lower payments for your clients. Check out the comparison below:

Frequently Asked Questions

in addition to elevated commissions, volume funding bonuses, and overrides from downstream partners, there are many other great benefits to our membership programs. To provide a thorough overview, we’ve assembled the answers to some of the most frequently asked questions. We look forward to working together!

Ongoing Training Webinars

To ensure we are providing our brokers and referral partners, new and veterans, with the proper training they need to be successful in our program, we are hosting biweekly training webinars for anyone who would like to learn more about our program and get all the latest updates to our lending criteria. We are also hosting monthly, topical breakout sessions to assist veteran partners with additional product information, prospecting tips and ways to fill their pipeline.

Membership Has Its Rewards

Membership Re-imagined

You’ve heard the old adage “membership has its rewards”, well get ready to be impressed by ARF’s exciting new Circle of Rewards Referral Partner Membership Program! The new program, re-imagined to cover every referral partner hot button, goes far beyond other programs by providing: higher commissions, higher residuals, volume bonuses, and for the first time, overrides and on downstream referral partner fundings.

Circle of Rewards

Why become a member? For starters, to gain access to our industry-leading loan products. Our average loan size is six times larger with terms over 3 times longer than a merchant cash advance! Larger loan amounts mean higher commissions for you, and longer terms mean your clients will enjoy affordable payments that won’t wreck their cash flow. We call these member benefits, your “Circle of Rewards.”

Circle of Influence

The program doesn’t stop there. For the first time, CEO Circle Members have the unique ability to recruit downstream partners, generating network fee revenue plus long-term override commissions from their new network of members. By simply getting others to join, a member can monetize their circle of business associates and build a strong revenue stream. We call these network member benefits, your “Circle of Influence” (COI).

WINDFALL

Loan Investment Program

Where can you find an investment with a return rate in the 30% range today? If you did, it would certainly be a windfall! That’s exactly what ARF is now offering its CEO Members by giving them an opportunity to invest up to 10% in the loans they fund. This new WINDFALL loan investment program is designed to build wealth among our CEO Members.

Loan Program Advantages

ARF Financial is a California licensed lender that has forged relationships with banks around the country that are committed to work with your clients so they can acquire a bank loan fast, without endless paperwork. That means the interest is tax deductible, rates are fixed, and the terms are transparent. Your clients receive the financing they need fast, with affordable payments that won’t increase as revenue grows.

Business Types We Lend To

From restaurants to liquor stores, to veterinary practices, financing solutions from ARF Financial help keep a wide variety of small businesses growing and profitable. Here are a few of the business types we can help with our loans:

Our Unique Loan Products

Bankroll – Revolving Line of Credit

Your business is always evolving. Wouldn’t it be great to have a loan product flexible enough to evolve with it? Now you do! Our new Revolving Line of Credit – BANKROLL, provides the MAX loan approval, a fixed loan term up to 36 months, and a fixed weekly payment – plus the flexibility to pay down or draw funds on an unlimited basis!

Interest-Only Flex Pay Loan

We believe growing your business shouldn’t mean sacrificing your cash flow, and with ARF’s Interest-Only Flex Pay Loan it doesn’t. It allows you to quickly access from $50,000 to $750,000 and low, interest-only payments for up to 1 year. And, it also carries an optional Line of Credit with unlimited draws for up to a year!

Lines of Credit

With a Line of Credit from ARF Financial, when opportunity knocks, business conditions change or unexpected expenses arise, you will be ready. It gives you 24-hour access to 5 separate loan drafts over a 6-month period. You can draw additional funds as needed and only pay for what you use!

Flex Pay Loans

Many merchants simply don’t dream big because they believe they can’t afford to borrow the funds needed to make those dreams real. Our Flex Pay loan solves that problem! Flex Pay allows your clients to defer up to 50% of their loan principal into the future, resulting in the lowest payments now!

CEO CIRCLE FREE TRIAL MEMBERSHIP

Fill out the form below to begin receiving all the great benefits that come with a CEO Circle Membership – Free for 90 days!

Minimum Qualifications

Industry Type

We lend to more than just restaurants. We have expanded to include many more approved industries. Click here to see the full list.

Credit Score

Your clients don’t need perfect credit to qualify. Applicants with an Equifax credit score of 551 or higher are acceptable.

Time in Business

Applicant must own the business. The business must be open and operating under the same ownership for at least one month (30 days).

Annual Sales

Your business must generate a minimum of $17,000 per month in sales ($200,000 annually) from both credit card and cash.

Quick & Easy Way to Apply

If you you have a client / business owner in need of working capital, simply have them complete our online application today. Every Circle Member receives a dedicated link to our online application for tracking purposes. There are 4 prequalification questions, 5 easy steps, and there is no hard credit pull so their credit will not be affected. Clients may also speak to your assigned loan consultant who is knowledgeable about the market, which loan product is the right fit, and will work with you and your client throughout the process.