Welcome Loan Stars Partners!

Capital Connections, just as it sounds, is the connection with you, our valued Referral Partners, and ARF Financial in order to remain in the know on all the latest promotions, webinar information, contests, prospecting tips, product and underwriting changes as well as success stories from other partners. If it’s happening in our Loan Star Rewards Program, you can find out about it here.

With today’s inflationary instabilities, now more than ever business owners must be financially prepared to pivot at any moment. That means quick access to the most affordable capital is essential to keep pace with the challenges they face. ARF Financial understands those changing needs and has introduced an Interest-Only Revolving Line of Credit, IO-Bankroll, to help merchants maneuver as quickly as the market fluctuates.

With IO-Bamkroll, clients only pay the interest on their outstanding balance for up to a year and can draw funds or make partial principal payments as often as they need during the 11-month revolving period. This ensures the client is in complete control of their finances based on the changing needs of the business.

Bankroll addresses the #1 concern of business owners everywhere who require the flexibility to access capital at a moment’s notice, while keeping their cash flow stable. We do this by providing highest approvals (up to $1,000,000), a fixed loan term (up to 36 months), and a fixed payment, PLUS the flexibility to draw additional funds or pay down the principal on an unlimited basis!

You decide when you want to borrow, how much you want to borrow, the amount of your payment, and how long to keep the line open. You are in complete control based upon your business’s unique needs that may change over time. And, Bankroll provides early payoffs without penalty!

With elevated upfront and residual commissions, generous performance bonuses, overrides from downstream partners, and exclusive access to superior products and promotions, there’s never been a better time to become a Loan Star Referral Partner! Check out the stellar new benefits that automatically come with this partnership.

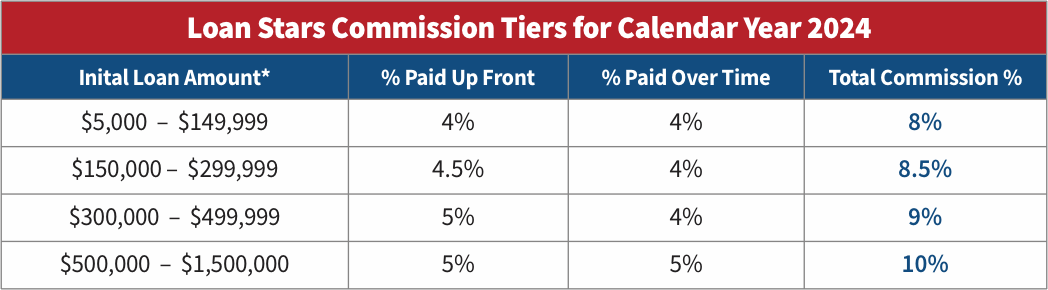

Star-Powered Commission Tiers

Skyrocketing Performance Bonuses

Top Approvals & Fundings in June 2024

Restaurant – $450,000

- Time in Business: 18 Years

- Annual Revenue $5.7 Million

- State: Massachusetts

- Credit Score: 700 – 750

- Loan Product: Revolving Line of Credit

- Loan Term: 104 Weeks

- Clients Initial Draw Amount: $248,770

Total Commission: $19,901

Medical Services – $400,000

- Time in Business: 13 Years

- Annual Revenue: $2.1 Million

- State: Alaska

- Credit Score: 800-850

- Loan Product: Interest-Only Revolver

- Term: 52 Weeks

- Client’s Initial Draw Amount: $400,000

Total Commission: $32,000

Retail – $400,000

- Time in Business: 18 Years

- Annual Revenue: $3,800,000

- State: Arizona

- Credit Score: 700-750

- Loan Product: Revolving Line of Credit

- Term: 104 Weeks

- Client’s First Draw Amount: $309,278

Total Commission: $24,742

Equipment Sales – $500,000

- Time in Business: 9 Years

- Annual Revenue: $5,600,000

- State: Pennsylvania

- Credit Score: 751-799

- Loan Product: Revolving Line of Credit

- Term: 104 Weeks

- Client’s Initial Draw Amount: $200,000

Total Commission: $16,000

Success Stories

We really enjoy hearing about the successes from our partners and, of course sharing them with others. There are many partners with unique, interesting and informative client success stories. You may read one that inspires you to try penetrating a new vertical. Maybe we’ll feature one of your stories here too!

Join the Program

Not a partner yet? Become a Loan Star and unlock unlimited earning potential simply by referring clients to ARF Financial. Referral Partners get exclusive access to new products and promotions with no annual memberships, expirations, or renewal fees. Visit our Loan Stars page to learn more.

Network Leaders

As a Loan Star you’ll have the unique opportunity to recruit your own network of Loan Stars. The larger your network, the bigger the opportunity to earn override commissions from downstream fundings! You can also cash in on Recruiting Bonuses. For every 50 Loan Stars you recruit you’ll receive $2,500! Learn more about it below.

Upcoming Training Webinars

The best way to be successful is to stay educated! We invite you to join one of our webinars to learn more about our program. Full training webinars are held twice a month and a topical breakout session webinar is scheduled once a month on a variety of topics.

A Restaurant Survival Tool for Inflation: Cash Discounting

Cash discounting is growing in acceptance with more than 30,000 restaurants and businesses adopting cash discounting programs. Even large corporations like Hilton and Starbucks are coming on board. While a small number of consumers will opt to pay cash, there has been little to no negative effects on consumers choices or loss of business by the merchant.

Commercial Disclosure Laws Create Legal Challenges for Referral Partners

You may be aware that new commercial financial product disclosure laws have been adopted in several states, but did you know that these laws impose significant obligations on both the providers of these products and the referral partners who source the customers for these providers? Are you and your funders ready for these changes? Here’s what to do.

MCA Funders in Legal Jeopardy Due to New Court Decisions

The merchant cash advance (MCA) industry has often walked a “legal” tight rope in its product offerings. Recent decisions by the U.S. District Court for the Southern District of NY (in Manhattan) have called certain MCA practices into question in upholding legal challenges to these practices as a legal sham which may violate the Racketeering and Corrupt Practices Act (“RICO”).

Need Help with Marketing?

Loan Stars can take advantage of the available marketing materials and customizations to help maximize their sales efforts. Whether you are focused on cold calling, digital marketing, email or direct mail, we provide support and resources to help you sell our unique loan products. Fully customized landing page, cobranded application and personalized marketing materials are available for $250.

Minimum Qualifications

Industry Type

We lend to more than just restaurants. Over the years we’ve expanded to include many more industry types. Click here to see the full list.

Credit Score

We can work with merchants that have less than perfect credit. An applicant must have a minimum Equifax credit score of 551 or higher.

Time in Business

Applicant must own the business. The business must be open and operating under the same ownership for at least one month (30 days).

Annual Sales

Your business must generate a minimum of $17,000 per month in gross sales ($200,000 annually) from both credit card and cash.

Our Unique Loan Products

BANKROLL – Revolving Line of Credit

Businesses are always evolving. Wouldn’t it be great to have a financial product that’s flexible enough to evolve with them? Now we do! Our new Revolving Line of Credit – BANKROLL, provides the MAX loan approval, a fixed loan term up to 36 months, and a fixed weekly payment – plus the flexibility to pay down or draw funds on an unlimited basis!

Interest-Only Bankroll Revolving Line of Credit

ARF Financial’s IO-Bankroll Revolving Line of Credit is unmatched. The 11-month revolving period gives your clients the flexibility to draw funds and pay down their principal balance as often as they need. Couple that with fixed terms up to 3 years and IO-Bankroll becomes a powerful tool that Referral Partners can use to help fuel their client’s business growth.

LOAN STARS PARTNER SIGN UP FORM

Become a Loan Star and Earn Up to 10% Commissions

Now’s the time to become a Loan Star Partner and take advantage of the BIG increases in commissions, performance bonuses and overrides!