The Founding Circle Membership Program

Refer Your Clients to ARF Financial and Earn Long-Term Income

The Founding Circle Membership Program is a continuation of our original Referral Partner program. There are no annual renewals or membership fees. As before, this program pays 3% commission at funding and 3% commission on residual fundings for up to three years. Members will receive a dedicated URL which will track all in inbound online application activity sent directly to our portal from your website or other marketing campaigns.

We will pay a 3% referral fee, based upon the principal amount of the initial new loan and the “cash out” portion of all additional advances, including line of credit draws, renewals, or re-finances that are made for a period of 3 years from the date of the initial loan.

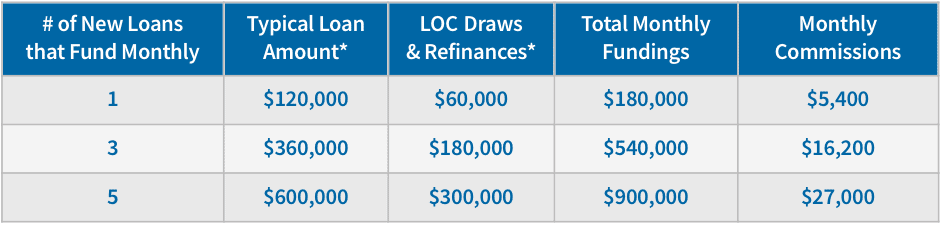

Here’s an Example of the Opportunity:

Typical Funding Scenario:

Merchant borrows $450,000 with no review of their tax returns and financials. Referral fee earned by broker is $13,500! Our average loan size is $120,000, and most loans refinance after 50% paid.

By introducing your clients and other sales minded professionals to ARF Financial, you can help ensure the success of their business, strengthen your own relationships and earn significant income! If you are interested in the Founding Circle Membership Program, please fill out the form below or contact your local loan consultant for more information.

Become a CEO Circle Member and Earn Higher Commissions!

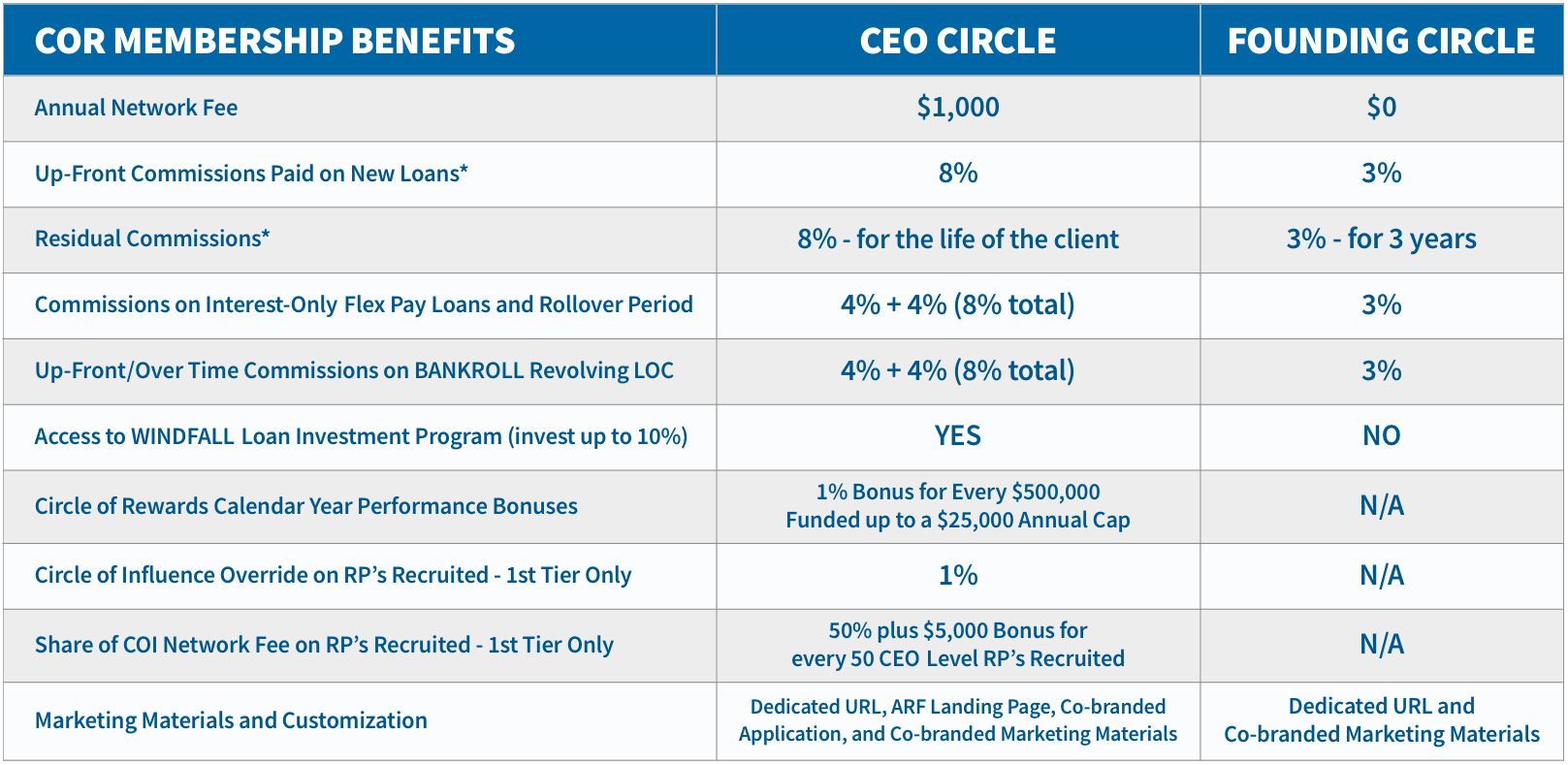

It’s the perfect time to become a CEO Circle Member with increased commissions, performance bonuses and a new loan investment program! Check out the table below and see all the valuable upgrades that come with a CEO Membership vs. Founding Circle.

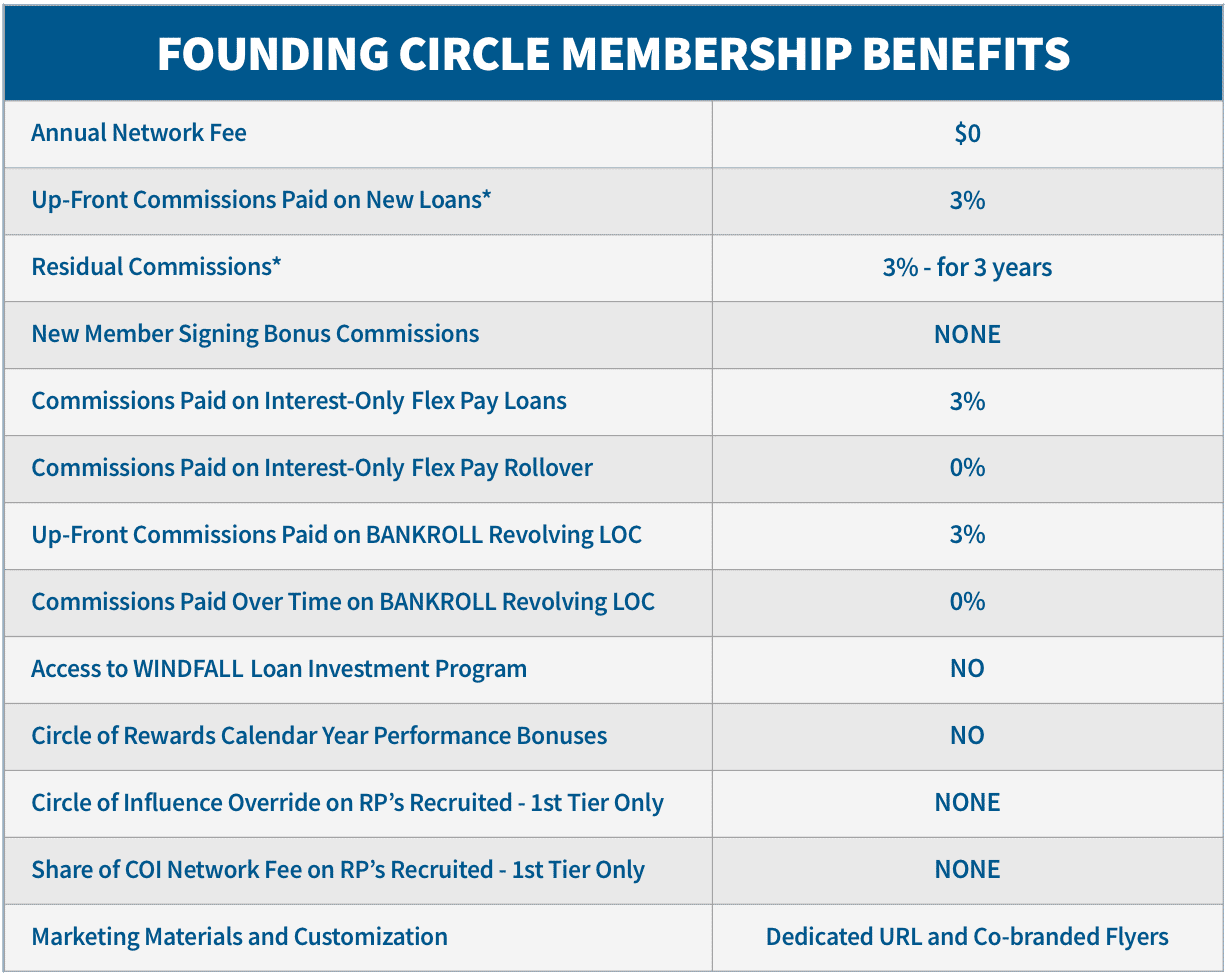

Benefits of our Founding Circle Membership

Over the past 20 plus years, we’ve come to understand that we have shared interests and common goals with our Referral Partners. Therefore, a long-term commitment in the form of a mutually beneficial alliance is necessary for a successful partnership. Check out the table below outlining the benefits of our entry-level, Founding Circle membership.

Sign Up to Sell Our Products!

By introducing your clients to ARF Financial, you can help ensure the success of their business, strengthen your own relationships and earn significant income! Fill out the form below to get started.

Loan Program Advantages

ARF Financial is a financial services company that has cultivated relationships with community banks around the country so your clients can acquire a true bank loan fast with limited paperwork. That means the interest is tax deductible, rates are fixed, terms are longer, and the details are transparent. Your clients receive the financing they need fast, with affordable payments that won’t increase as revenue grows.

Industry Types We Lend To

Click here to see full list

From restaurants to liquor stores, to veterinary practices, financing solutions from ARF Financial help keep a wide variety of small businesses growing and profitable. Here are a few of the business types we can help with our loans:

Our Unique Loan Products

BANKROLL – Revolving Line of Credit

Your business is always evolving. Wouldn’t it be great to have a financial product flexible enough to evolve with it? Now you do! Our new Revolving Line of Credit – BANKROLL, provides the MAX loan approval, a fixed loan term up to 36 months, and a fixed weekly payment – plus the flexibility to pay down or draw additional funds on an unlimited basis!

Interest-Only Flex Pay Loan

We believe growing your business shouldn’t mean sacrificing your cash flow, and with ARF’s new Interest-Only Flex Pay Loan it doesn’t. It now allows you to quickly access from $50,000 to $750,000 with low, interest-only payments for up to 1 year. And now, it also carries an optional Line of Credit with unlimited draws for up to a year!

Lines of Credit

With a Line of Credit from ARF Financial, when opportunity knocks, business conditions change or unexpected expenses arise, your clients will be ready. It gives them 24-hour access to 5 separate loan drafts over a 6-month period. They can draw funds as needed and only pay for what they take!

Flex Pay Loans

Many merchants simply don’t dream big because they believe they can’t afford to borrow the funds needed to make those dreams real. Our Flex Pay loan solves that problem! Flex Pay allows your clients to defer up to 50% of their loan principal into the future, resulting in the lowest payments now!

What Our Customers Are Saying