Financing America’s Manufacturers

For more than two decades, ARF Financial has helped hundreds of manufacturing businesses across America secure over $1 billion in funding to innovate, grow and thrive. Our superior loan products are perfect for expansion projects, investing in new equipment and technology, stockpiling raw materials, hiring additional staff and consolidating more expensive debt. Our goal is to provide fast access to loan products that are unmatched in the industry, and employ knowledgeable loan consultants focused solely on helping manufacturers succeed.

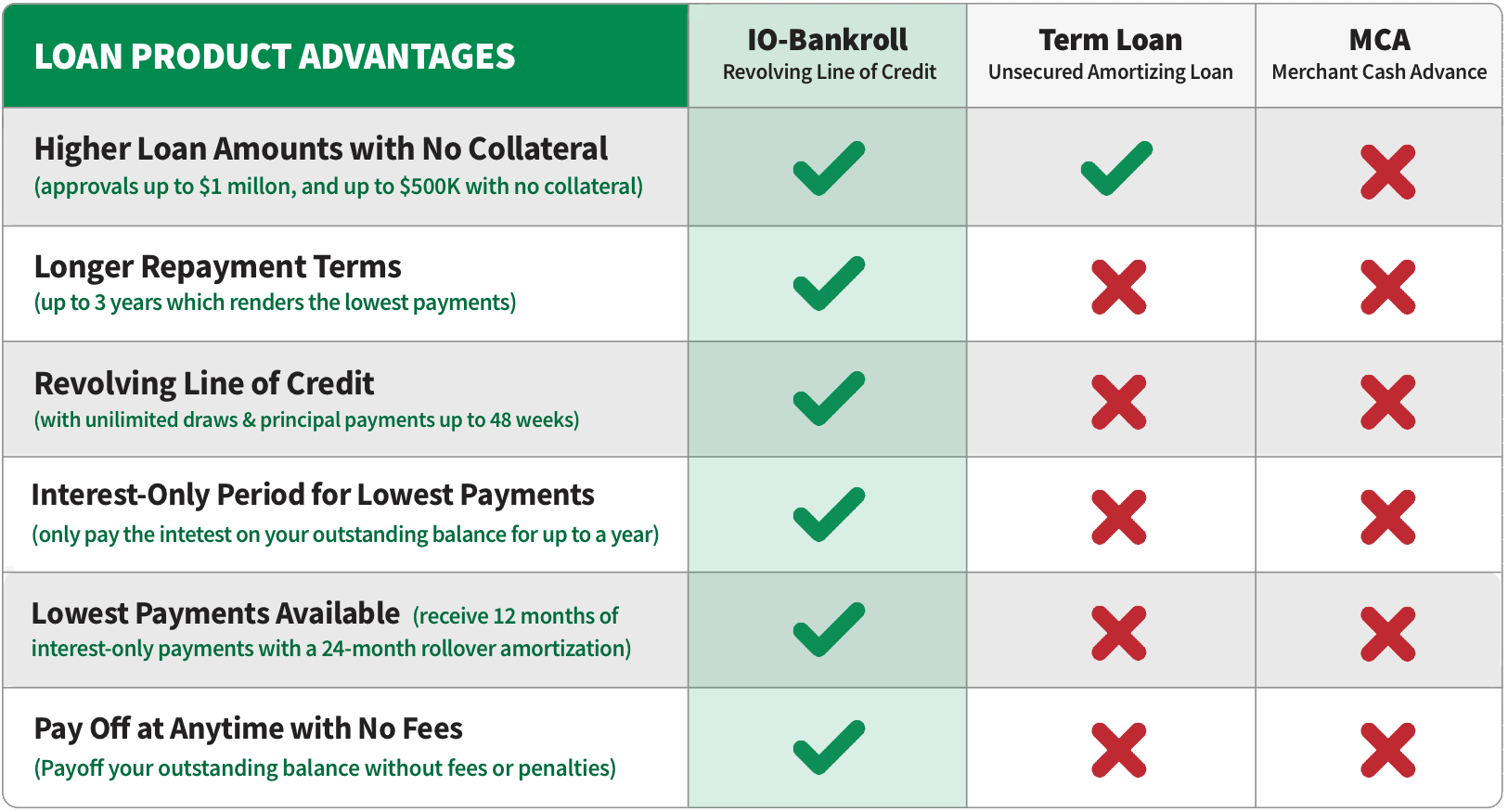

Superior Loan Products

Minimum Qualifications – Are We a Good Match?

The manufacturing industry is buzzing with innovation and adapting to new technologies that require funding and investment. However, financing the future of manufacturing can be daunting. To keep up with the demands of cutting-edge technology, upgrading factories, and enhancing productivity, manufacturing companies require a substantial amount of working capital. Obtaining funding isn’t always easy, which is why business loans, lines of credit, and other financing options may be needed. ARF Financial has created two unique manufacturing lines of credit designed specifically for manufacturers who have unique issues that keep them accessing traditional financing. It’s vital that manufacturers have the financial resources to keep up with the ever-evolving landscape of technology and competition. Micro factories and smart factories are disrupting the manufacturing industry on top of labor shortages that cause expensive delays. Supply chain issues and additive manufacturing are also disrupting the industry across the board. With well-planned financing strategies, manufacturers can stay ahead of their competitors and continue to contribute to the growth of the industry. Book meeting with the our manufacturing team now to discuss your needs and how we can tailor a financing plan that allows you to borrow now and pay back at your own pace.

3 Manufacturing Industry Trends to Watch in 2024

On average, the manufacturing industry has grown 6.6 percent per year between 2017 and 2022; in 2022, the industry’s market size was measured at $8.8 trillion (in revenue). These are significantly impressive numbers, considering the stubborn presence of labor shortages, supply chain issues, and an economy crippled with the residual effects of a global pandemic–and they far surpass a lot of experts’ previous predictions. But we’re not totally out of the woods: What’s expected to plague the manufacturing industry in 2024 is inflation, a lack of high-caliber workers, and cybersecurity concerns. As we head into 2024, let’s take a look at 3 industry trends we predict will be critical in maintaining this growth trend while mitigating risk.

1. Talent Management

Employee engagement and retention are always top of mind for business owners. With a labor shortage gripping the manufacturing industry, it will be more important than ever that management focuses on hiring the best and brightest–and keeping them around. Remember, lack of a strong workforce costs your business time and money. Companies are less able to respond to economic shifts in an efficient manner if the right people aren’t in place who can quickly change course. Some strategies to consider when looking to reduce churn include wage increases; greater focus on diversity, equity, and inclusion (DEI); and flexibility, including a potential hybrid working structure.

2. Technology

We know technology is continuously improving, and nowhere more so than in the manufacturing industry. Investing in and implementing new technology has been the saving grace for a lot of manufacturing companies, as it places them in a better position to quickly adapt and rebound during times of economic uncertainty. To streamline operations, manufacturers surveyed by Deloitte noted their plans to focus on robotics and automation (62 percent) and data analytics (60 percent) in 2024. For instance, it’s much simpler for a company to forecast when they have robust data and analytics capabilities. And with automation in place, manufacturers can increase productivity and tackle the labor shortage at the same time.

3. Supply Chain Focus

The uncertainty surrounding the shortage of materials still warrants concern from manufacturers. To lessen the impacts of these supply chain disruptions, manufacturers have adopted more advanced digital technologies, strengthened their partnerships with suppliers, and created redundancy in the supply chain.

It’s also worth noting the importance of staying local. Manufacturers have increased their operations locally in an effort to limit avoidable snags, like logistics flukes or transportation issues. There’s also increased focus on building production factories right here in the United States–a venture that is further bolstered by The Infrastructure Investment and Jobs Act (IIJA).

We’ll continue to keep an eye on these trends over the course of 2024. All the hard work that was done in terms of innovations in the manufacturing industry will surely get more traction in the coming year. It’s important to position your company for growth while also keeping an eye on potential setbacks: in essence, hope for the best but prepare for the worst. And for more content on the latest industry and financial trends, you know where to find us.

Your privacy is important to us. ARF Financial will never sell or rent your information to any third party. Click here for more information about our privacy policy.

Use the sliders below to indicate your annual sales, time in business and credit score.

| Term | Loan Amount |

|---|---|

| 12 month | |

| 18 month | |

| 24 month | |

| 36 month |

Enter your information below to request a quote. Your local loan consultant will crunch the numbers and prepare a custom quote based on your unique circumstances.

Terms and Conditions

ARF Financial LLC is an exclusive third party originator of commercial loans for state charted community banks throughout the United States (“Partner Banks”), (collectively herein referred to as “Lender”). This Preliminary Loan Amount is based upon pre-underwriting standards consistent with Lender’s guidelines. This Preliminary Loan Amount is based upon the information provided by the Merchant in the Loan Calculator. This approval is contingent upon the accuracy and truthfulness of the information provided by the Merchant therein and on any additional information discovered by Lender during the Underwriting process including but not limited to the review of all financial information provided by the Merchant, the personal credit of any guarantor and/or any information available from the public domain relating to the business’ or the guarantor’s outstanding liens and judgments, collection issues, history of fraud, bankruptcy, or criminal activity; the status of the Merchant’s business entity with the State where they are located; or any other information that may reflect on the business or guarantor’s ability to repay this loan. The terms of this Preliminary Loan Amount may change based upon the review of all information noted above. The terms of this Preliminary Loan Amount (noted above or if modified during the Underwriting process) are not deemed approved until the Merchant agrees to and executes all necessary Loan documents and the Loan documents are countersigned and approved by an Officer of Lender. If Merchant executed no Universal Merchant Credit Application then this Preliminary Loan Amount is for discussion purposes only.

Latest News from Our Manufacturing Blog

How to Increase Employee Retention in Manufacturing

Industries across the board see similar patterns with employee turnover, which is why it’s so critical to keep an eye on your business and hone in on how you can hire and retain the best talent.

When Manufacturing Meets AI

There’s a nationwide push to get more products manufactured here at home. Companies have started to think outside the box in terms of ramping up staffing when the labor pool leaves much to be desired: Artificial Intelligence, or AI.

What’s Causing the Labor Shortage in Manufacturing?

There is still a deficit of 500,000 open positions in manufacturing that stubbornly remain unfilled. What is the root cause of this labor shortage? That’s what we’re here to shed some light on.

3 Manufacturing Trends to Watch in 2023

In 2023, the manufacturing industry will be affected by inflation, a lack of high-caliber workers, and cybersecurity concerns. Let’s take a look at 3 industry trends we predict will be critical.