Restaurants Are Not Immune To Data Breaches

Restaurants Are Not Immune To Data Breaches

Technology is often a double-edged sword. Although it can make operating your restaurant a little easier, it can also create new liabilities and risks. We understand that you and your customers truly appreciate the ease of using debit and credit at the point-of-sale.

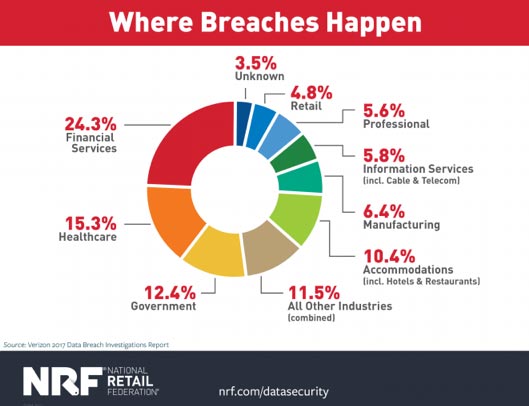

However, recent stats reveal that the point-of-sale is one of the most vulnerable parts of your small business. Cyber criminals are likely to target the POS rather than other areas of your restaurant.

Hackers consider restaurants to be soft targets. The reason is that a restaurant’s system is easier to penetrate than large, multinational corporations. Large businesses invest in full-time and on-site tech groups and stringent security practices.

How Hackers Target a Restaurant’s POS System

One of the most common intrusion methods hackers’ use is malicious software programs, or RAM scrapers. Identity thieves use automated Internet searches to find unprotected or moderately protected restaurant point-of-sale systems.

This RAM scraper can download itself directly to your system usually under a harmless filename. In many cases, one or more of your own employees (or someone with access to your restaurant’s system) can install the malware on the server or your device. Without timely detection, this RAM scraper can siphon off customer debit and credit card information from your computer system’s memory.

This sensitive information is then available for hackers to use or sell, which makes your customers’ credit completely vulnerable. Be aware that you could be held liable for the financial losses a data breach can cause.

Minimize Your Restaurant’s Losses

Here are some key steps you can take to minimize losses from data breaches:

Monitor

Numbers do not lie. Find an effective way to track your restaurant’s transactional data from your Back-of-House (BOH) and Point of Sale (POS) systems. Use a spreadsheet method or work with an external system to integrate data from all the sources. Data collection and monitoring is essential.

PCI Compliance

Of course, all restaurants want to enjoy a spotless reputation. To do so, you must ensure optimal security for your patron’s data. Perhaps, the most effective way to achieve this is to make sure that your restaurant’s POS system complies with PCI (Payment Card Industry).

PCI compliance entails a set of rigorous standards that ensure all organizations that accept, store, process, or transmit credit card data maintain a secure environment, thereby, allowing consumers to trust them with their confidential payment card information.

This compliance requires you take additional steps where possible to maintain technological security.

Credit Card Encryption

Credit card information is incredibly tempting to hackers – but there is no use stealing this information if these hackers can’t understand it. Many state-of-the-art POS systems have the unique capability to encrypt credit card data instantly as soon as you swipe a card.

As an integral part of the encryption process, the transfer of the information is swift and secure throughout the entire transaction process. By ensuring adequate encryption of the information, both your organization as well as your customers can enjoy peace of mind in the security of the financial transaction.

By encrypting credit card numbers in your card reader hardware, as soon as you swipe a card, you can keep hackers from stealing credit card numbers by installing malicious software on your network.

Cloud-Based POS Software

To secure your customers’ information, cloud-based POS systems are a safer and wiser way to safeguard your restaurant’s information than legacy POS systems. It is primarily because legacy POS systems tend to store sensitive information in the technology within your restaurant, leaving your customers’ credit card information at greater risk than a cloud-based POS system, where information is immediately transferred to the cloud.

Stay Ahead Of Hackers

If your POS provider claims they have made considerable improvements to their software after the attack happened, you should take it with a grain of salt. Although their seemingly reassuring message may suggest that they are on top of security, it really means they were just as prone to a data breach in the first place. This approach is reactive.

Instead, you should look for POS software that reviews historic hacks, and is proactive. Although there is no such thing as an invincible POS provider, many companies make intentional and purposeful decisions to cover their bases better than others. You should ideally be using one of these POS providers in your restaurant.

Bottom Line

You are not immune to a cyber-attack. However, with meticulous planning and a hands-on attitude toward cyber security, you can minimize the cyber security risks your restaurant faces. If you are ready to start and need restaurant funding for more effective POS software, ARF Financial can help. Our no fee Line of Credit is a perfect solution. Our rates are affordable, there’s no need for collateral, and there is minimal paperwork. We can approve you in 24 to 48 hours and your credit will not be impacted by this application! APPLY NOW.