Restaurant Loans and Restaurant Financing

Is Your Restaurant Ready to Grow?

Lines of Credit • Working Capital Loans • Flex Pay Loans • Interest-Only Loans

As the restaurant industry experts, our team of seasoned loan consultants specialize in providing the trusted lending services you deserve to keep your restaurant profitable and on track to achieve your long-term goals. It doesn’t matter if you’re a single-unit operator, a multi-unit operator, or a nationally recognized chain, we can help you capitalize on your business’ potential with access to the right restaurant financing products, and we do it fast.

ARF Financial has a well-established track record of helping restaurant owners with a variety of financing solutions to tackle any growth project or overcome a seasonal slow down. Our focus is to get you the capital you need when you need it, while providing seasoned guidance to help you maximize your return on investment.

Running a restaurant takes much more than just culinary skills. It also takes ongoing access to capital to remain relevant and profitable. Banks continue to tighten their lending requirements resulting in diminished access to restaurant loans. This means that many owners are forced into more expensive financing options such as merchant cash advances to make ends meet.

Size Matters!

Larger Loan Amounts, Longer Terms & Big Rewards

Big projects usually mean big upfront investments, something you can’t get from a merchant cash advance. If you’re ready to take the plunge and go BIG this year, we have financing that’s the perfect fit. You can now borrow up to $1,000,000 with terms up to 36 months to fund your big projects while keeping your costs low. Our average loan size is over six times larger and repayment terms are more than three times longer than a Merchant Cash Advance. Larger loan amounts mean you can invest in growth opportunities that will make a significant impact to your bottom line, and longer terms mean your payments are manageable and won’t interfere with your cash flow!

CHECK OUT THE COMPARISON

Completing an application only takes 10 minutes and won’t affect your credit.

Why is ARF Financial Different?

Since 2001, ARF Financial has helped tens of thousands of restaurant owners obtain approvals in excess of a billion dollars! We know restaurants, and we have loan products specifically designed for restaurateurs. Over the years, it’s become clear, our clients want quick access to larger loan amounts with longer terms that deliver low payments and won’t interfere with their cash flow. And, that’s what we do! Plus, everyone loves cash back rewards right? Well, we do that too!

ARF is your best option for achieving the business growth you’ve dreamed of. Here’s how:

Advantages of ARF Financial’s Restaurant Loans

Use of Funds

ARF Financial is devoted to sticking by your side for the long haul, ensuring you can capitalize on new business opportunities as they develop. Here are just a few of the ways our clients have put their restaurant financing to work:

Client Reviews

How to Qualify for a Restaurant Loan

Restaurant loans are approved based on different qualifying criteria. No single requirement will guarantee an approval. However, restaurant owners should be prepared to produce key documents about their business and other personal data to receive an approval.

Time in Business

The length of time the business has been operating is an important factor considered during the approval process. Restaurants that have been open and operating for at least one month (30 days) can qualify for a restaurant loan.

Business Checking Account

To qualify, we look at your business’s most recent 3 months of bank statements. In accessing your business’s credit worthiness, your account gives definitive evidence of your monthly cash flow and helps determine loan amount.

Credit Score

ARF considers a mix of criteria, not just your credit score. We have partnered with many banks to offer even more options for restaurant owners with less than perfect credit. A minimum Equifax credit score of only 551 is required.

Sales Volume

To qualify, your restaurant must consistently generate a minimum of $200,000 in annual sales (approximately $17,000 per month) actual or projected. Total sales includes both cash sales and credit card receipts.

Debt to Credit Ratio

ARF Financial, like most lenders, also examines your debt to credit ratio in order to qualify for a restaurant loan. If your restaurant is carrying too much debt, we will regularly offer to pay off competitor loans if your business qualifies.

Hassle-Free Process

ARF Financial has built relationships with banks around the country, so you can acquire a restaurant loan quickly with limited paperwork. These are actual bank loans, not cash advances. Repayment has nothing to do with your credit card receipts. This means the interest you pay is tax deductible, rates are fixed, and you know the terms ahead of time. Our clients get the financing they need quickly, with manageable payments that won’t increase as revenue grows. With an ARF Financial restaurant loan, you actually are rewarded for your success and you keep more of what you earn.

How to Apply for a Restaurant Loan

If you are a business owner looking for a restaurant loan with low rates, fixed terms and affordable payments, simply complete our online application today. It’s simple, only takes 10 minutes and won’t affect your credit. We have local loan consultants who are knowledgeable about your specific market and will assist you throughout the process. Get Started Here!

Our 2024 Best Restaurant Financing and Restaurant Loan Products

ARF Financial has restaurant loans and restaurant financing options designed specifically for the industry. For over two decades, our company has been the #1 lender for restaurants and hospitality businesses. Take a look at the 2024 line up of our best restaurant loan products:

BANKROLL – Revolving Line of Credit

Your business is always evolving. Wouldn’t it be great to have a financial product flexible enough to evolve with it? Now you do! Our new Revolving Line of Credit – BANKROLL, provides the MAX loan approval, a fixed loan term up to 36 months, and a fixed weekly payment – plus the flexibility to pay down or draw additional funds on an unlimited basis!

Interest-Only Flex Pay Loan

We believe growing your business shouldn’t mean sacrificing your cash flow, and with ARF’s new Interest-Only Flex Pay Loan it doesn’t. It now allows you to quickly access from $50,000 to $750,000 with low interest-only payments for up to 1 year. And now, it also carries an optional Line of Credit with unlimited draws for up to a year!

Lines of Credit

With a Line of Credit from ARF Financial, when opportunity comes knocking, business conditions change or unexpected expenses pop up, you’ll be prepared. Our Line of Credit gives you 24-hour access to 5 separate loan drafts over a 6-month period. You can draw funds as needed and only pay for the funds you take!

Flex Pay Loans

We’ve found that many business owners simply don’t dream big because they are convinced they can’t afford to borrow the funds needed to make those dreams real. Our Flex Pay loan solves that problem! Flex Pay allows you to defer up to 50% of your loan principal into the future, resulting in the lowest possible payments now!

What is a Restaurant Loan?

A restaurant loan is a lending product designed specifically for owners and operators of a restaurant and other hospitality businesses. A restaurant loan takes into consideration the unique needs of restaurants including seasonality, business model, partnership structure and timeliness of funding for emergencies such as kitchen repairs. Our restaurant loans are also used to retain equity or buy back equity from business partners. Some restaurant owners simply use as bridge financing until traditional financing is acquired.

Since 2001, ARF Financial has accommodated the unique needs of the restaurant and hospitality industry, offering restaurant loans in the form of lines of credit, flex pay loans, revolving lines 0f credit, and interest-only loans. Loan amounts are available from $5,000 to $750,000 and no need for tax returns or financial statements .

Our simple, 5-step restaurant loan online application allows quick approvals and funding in as little as 3 days. There are no hard credit pull and no impact to your credit score. Our loan consulting team can walk you through the many restaurant loan options available. Simply choose your state on the map and contact your local loan consultant for information on our restaurant loans.

Who needs a Restaurant Loan?

Restaurant loans and restaurant financing are available to any owner who needs capital to fund things like equipment financing, inventory financing, building renovations, restaurant expansions, opening another location, upgrading POS systems, buy out a business partner, liquor licenses, pay for franchise obligations, adding catering services, revamping restaurant menu and bar options, marketing and advertising, or simply stabilizing cash flow. These are just a few recurring reasons restaurant owners choose ARF Financial first.

Smart restaurateurs are choosing our restaurant loans because rates are low, the terms are longer, and payments are fixed. These restaurant loans are not tied to your credit card receipts which means you have access to a working capital cushion that is available for any business opportunity, repairs or for cash flow needs.

Restaurant Loan vs. Merchant Cash Advance?

A merchant cash advance is not a restaurant loan. It is a form of factoring where a financial services company buys an amount of your future credit card sales at a discount, typically 30% to 38%, and then electronically debits a percentage of your daily credit card receipts until the agreed upon amount has been repaid.

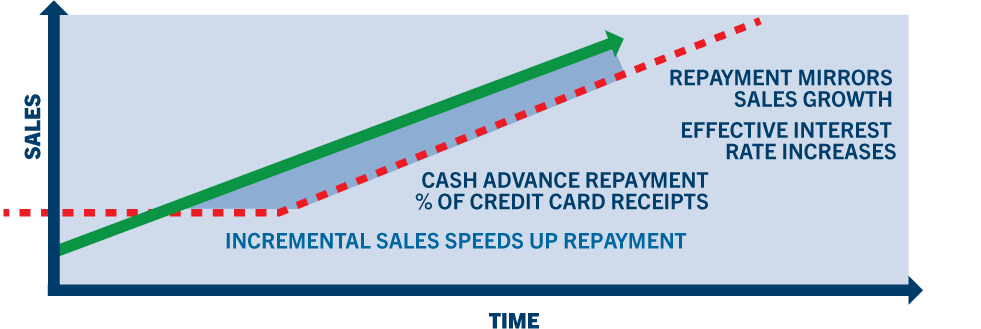

The problem? As shown in the graph, the more money you make (higher sales), the faster the cash advance provider gets paid back, thus raising the cost of funds to your business significantly. The shorter the term, the more expensive the advance becomes.

Restaurant owners, like many small businesses, are frequently being offered cash advances by a myriad of companies and/or brokers. Unfortunately, with many cash advance providers, your payment can change each week, or even daily, based upon your credit card sales. While merchant cash advances may appear to be a quick and easy option for busy restaurant and small business owners, the reality is a business loan is actually just as quick and way less expensive in the long run. ARF Financial offers larger loan amounts, longer terms and fixed, weekly payments that never change – great for budgeting and cash flow. All too often, the actual cost and inner workings of a merchant cash advance depends on the company offering it. With ARF Financial, there is no need to change your existing credit card processor, no complicated reconciliations to perform, and the repayment terms are made clear up front.

If your restaurant business is growing, don’t pay back your cash advance with a percentage of your Visa and Mastercard sales! As a successful restaurateur, why undermine your business’ operating health by giving away your new increased sales? Also, unlike a merchant cash advance, the interest on our business loans is tax deductible. This effectively lowers the total cost of your cost of funds even more in the long run.

A business loan with ARF Financial is the preferred choice compared to a merchant cash advance. Rates are lower, payments are fixed, terms are longer and the interest you pay is tax deductible. Most importantly, as your sales increase, your payments remain fixed. That means you, the restaurant owner, reap the benefits of increased sales, not the cash advance company. No matter what the future holds, ARF Financial is your best choice for a business loan, restaurant loan, or restaurant financing to capitalize on new opportunities – often when conventional banks simply won’t consider it.

Restaurant Loans and Restaurant Financing That Fit Your Business

Single-Unit Restaurants

Replace or repair equipment, overcome a financial hurdle, or seize an opportunity to grow with ARF Financial.

Multi-Unit, Franchise & Quick Service

Seize the next opportunity to expand your business while maximizing your return with flexible financing.

Bars & Taverns

Upgrade your space, refurbish your bar, improve your inventory, and more with our tavern financing options.

Caterers

Expand your menu, hire new staff, grow your operations, or move into a bigger space with loan terms that make sense.

Bakeries & Cafes

Explore a new menu item with a lender who is uniquely poised to help your business with the funding it needs.

Specialty Food Shops

Keep your inventory unique and of the highest quality with the right funding in place at all times.

Mall Food Outlets

Hire more staff, replace your equipment, and maintain food and supply costs with flexible funding options.

Gourmet Food Stores

Take advantage of new opportunities to grow your store or increase product offerings with a trusted lending partner.

Use our Restaurant Loan Calculator to Find Out How Much You Qualify For

Use the sliders below to indicate annual sales, time in business and credit score.

| Term | Loan Amount |

|---|---|

| 12 month | |

| 18 month | |

| 24 month | |

| 36 month |

Loan amounts may be increased with the review of tax returns and financials. Time in Business – Must be operating under the same ownership and concept. Homeownership – Home must be in your name. Bankruptcy – Includes individual and business bankruptcy. The use of this Loan Calculator tool is intended for illustrative purposes only and is not based upon any information about the user and does not represent a specific loan offer or terms that may be accepted by the user. A specific loan proposal can only be provided after completion of an application. Please provide the requested contact information if you wish to be contacted by one of our loan consultants to receive a written quote.

Terms & Conditions

ARF Financial LLC is an exclusive third party originator and servicer of commercial loans for state charted community banks throughout the United States (“Partner Banks”), (collectively herein referred to as “Lender”). This Preliminary Loan Amount is based upon pre-underwriting standards consistent with Lender’s guidelines. This Preliminary Loan Amount is based upon the information provided by the Merchant in the Loan Calculator. This approval is contingent upon the accuracy and truthfulness of the information provided by the Merchant therein and on any additional information discovered by Lender during the Underwriting process including but not limited to the review of all financial information provided by the Merchant, the credit of any guarantor and/or any information available from the public domain relating to the business’ or the guarantor’s outstanding liens and judgments, collection issues, history of fraud, bankruptcy, or criminal activity; the status of the Merchant’s business entity with the State where they are located; or any other information that may reflect on the business or guarantor’s ability to repay this loan. The terms of this Preliminary Loan Amount may change based upon the review of all information noted above. The terms of this Preliminary Loan Amount (noted above or if modified during the Underwriting process) are not deemed approved until the Merchant agrees to and executes all necessary Loan documents and the Loan documents are countersigned and approved by an Officer of Lender. If Merchant executed no Universal Merchant Credit Application then this Preliminary Loan Amount is for discussion purposes only.

Quick & Easy Online Application